Types Of Tax In Malaysia

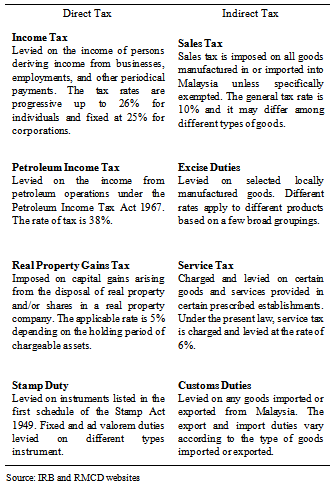

10 for sales tax and 6 for service tax.

Types of tax in malaysia. It is also commonly known in malay as nombor rujukan cukai pendapatan or no. What supplies are liable to the standard rate. The income tax rate for residents is calculated on the amount of income and is much more precise.

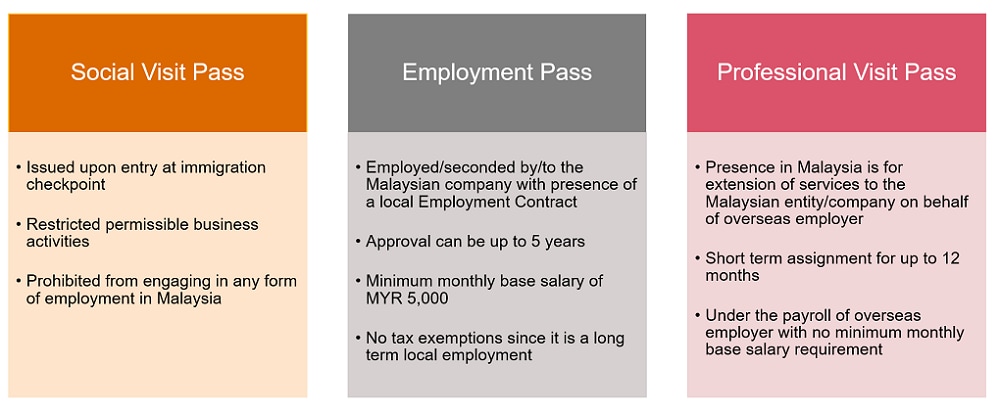

Every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. Any work or professional service performed or rendered in malaysia in connection with or in relation to any undertaking project or scheme carried on in malaysia are deemed to be services under contract.

Contract payments to nr contractors. Tax deductions in malaysia are available in numerous cases including medical expenses purchase of books computers and sport equipment or education fees. An income tax number or tax reference number is an unique identifying number used for tax purposes in malaysia.

Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. This section explains the payment types their definition and withholding tax applied. This deduction of tax at source does not represent a final tax which is determined upon the filing of the tax return.

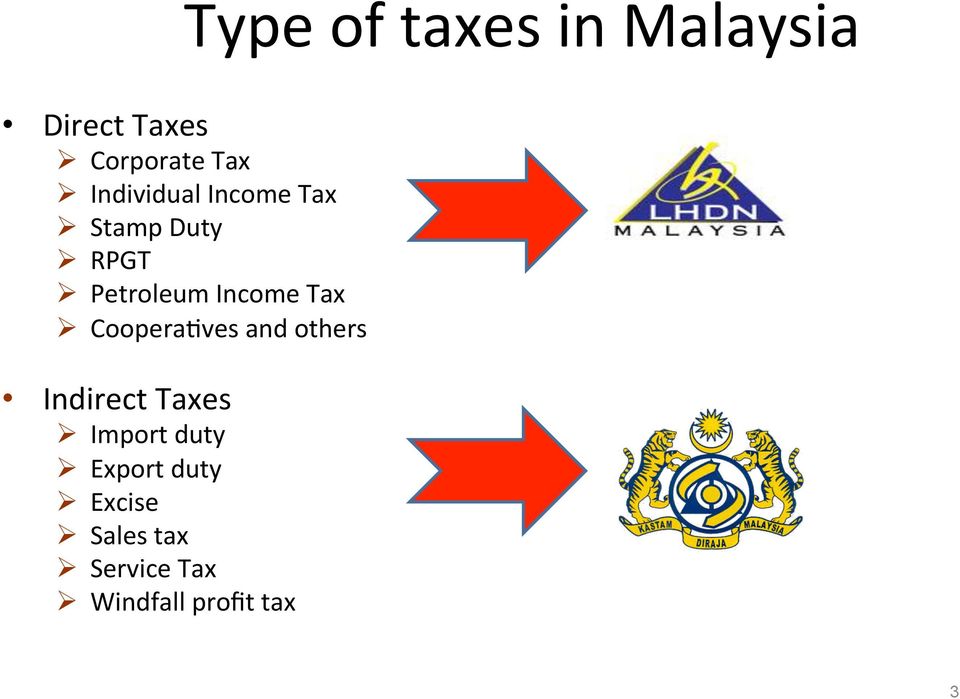

Type of indirect tax. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra.

The income is classified into 8 different tax groups ranging from 0 to 26. Income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business.

Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst. Income that is attributable to a place of business as defined in malaysia is. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type the most common tax reference types are sg og d and c.

The inland revenue board of malaysia malay.