Tax Incentives In Malaysia

Tax incentives in malaysia.

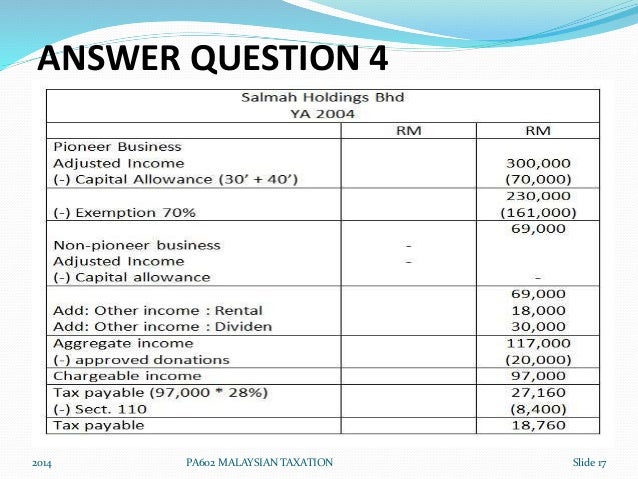

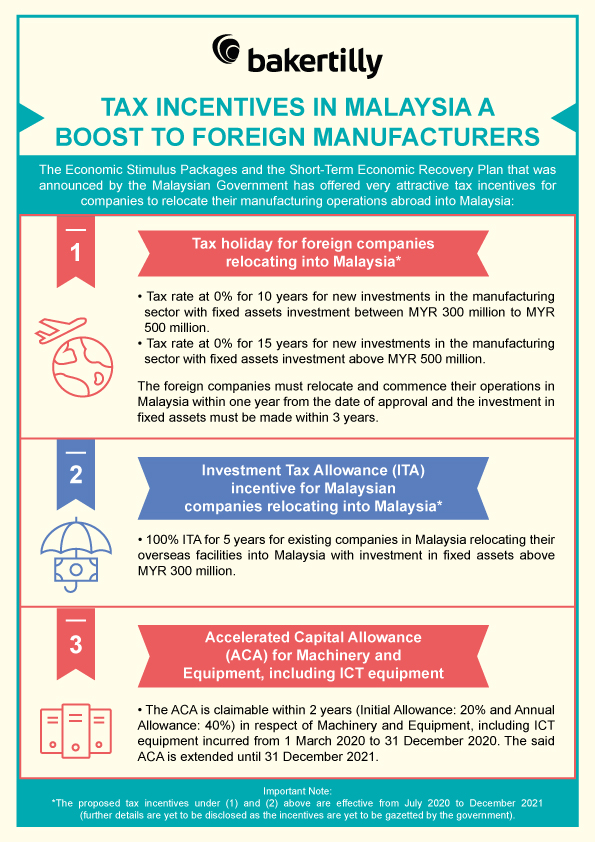

Tax incentives in malaysia. These acts cover investments in the manufacturing agriculture tourism including hotel and approved services sectors as well as r d training and environmental protection activities. Nevertheless a company eligible for a certain tax incentive might only pay an average effective tax rate of 7 5 with only 30 of the company s profit being subjected to tax. In malaysia tax incentives both direct and indirect are provided for in the promotion of investments act 1986 income tax act 1967 customs act 1967 sales tax act 1972 excise act 1976 and free zones act 1990.

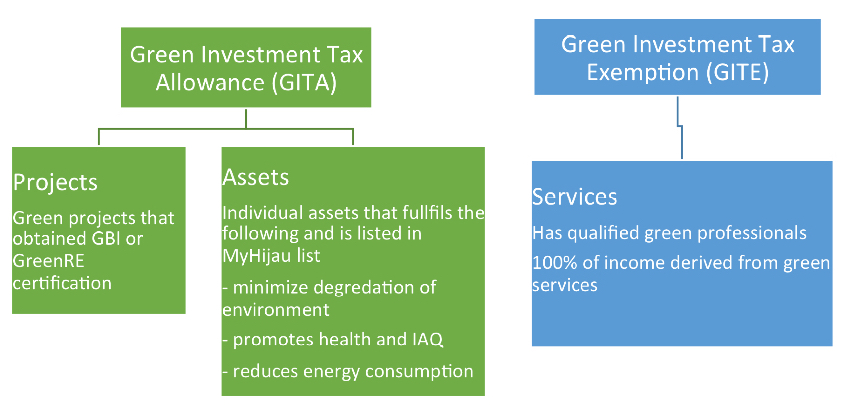

Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. In malaysia tax incentives both direct and indirect are provided for in the promotion of investments act 1986 income tax act 1967 customs act 1967 excise act 1976 and free zones act 1990. There are different types of tax incentives offered in malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

Msc malaysia companies are eligible for incentives which include the following. Dated 7 july 2017 for tax incentives to promote the establishment of principal hubs in malaysia. Tax incentives in malaysia posted on april 23 2020 june 9 2020 in accounting tax by 1ndustrymal ysia there are many types of tax incentives provided by malaysian government to attract foreign or local investors for investment in certain industries in malaysia.

A principal hub is a company incorporated in malaysia and that uses malaysia as a base for conducting its regional and global businesses and operations to manage control and support its key functions. Income tax exemption for five years and extendable by five years on statutory income or value added income derived from services provided in relation to core income generating activities for msc malaysia. Many tax incentives simply remove part or of the burden of the tax from business transactions.

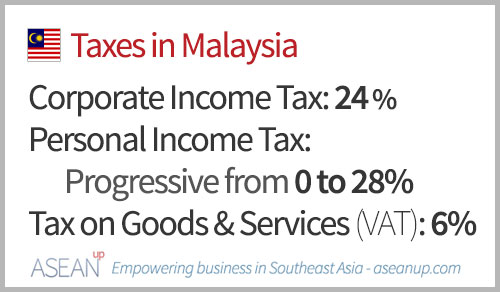

In malaysia the corporate tax rate is now capped at 25. Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income. Pioneer status ps is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years.

This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. These proposals will not become law until their enactment and may be amended in the course of their passage through. Generally tax incentives are available for tax resident companies.

This is a good.