Tax Evasion In Malaysia

Usually tax evasion involves hiding or misrepresenting income.

Tax evasion in malaysia. On the first 2 500. Picture by firdaus latif. This is so you don t suddenly fall off the grid which could put you in a high risk profile for tax evasion.

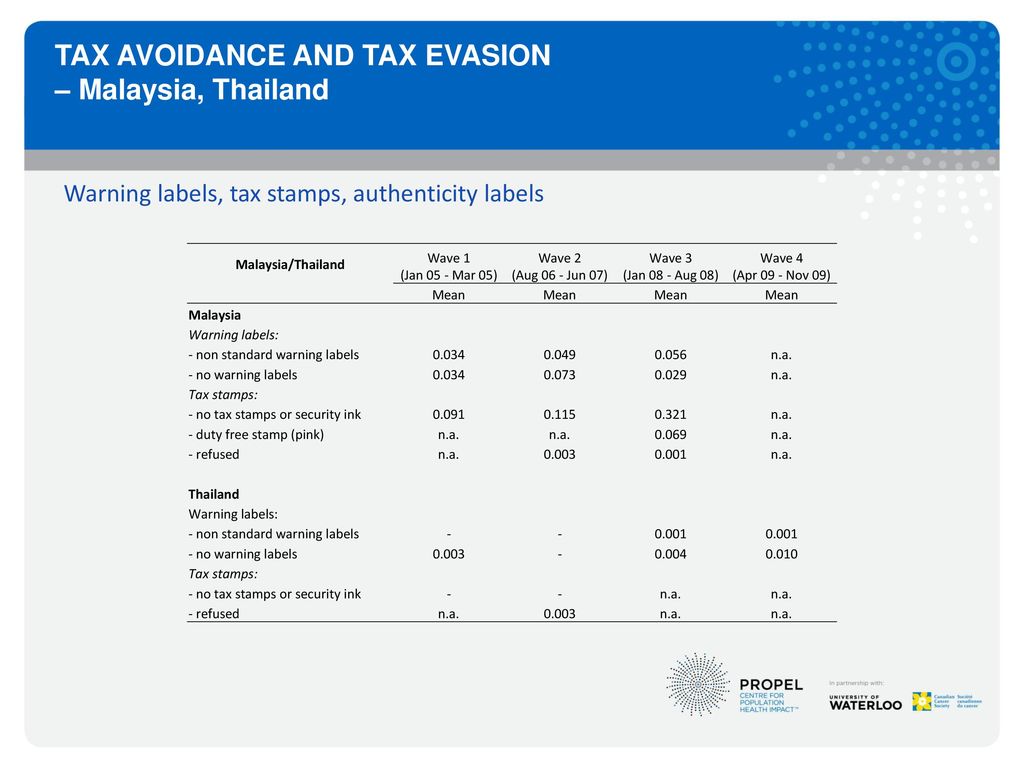

If you have information about fraudulent or possible criminal activity. 2003 that investigated the influence of education on tax avoidance and tax evasion by using questioner method. The tax laws of malaysia state the legal boundaries within which all tax related activities are to be conducted.

As the name implies tax investigation is a method of enforcement conducted by the inland revenue board malaysia irbm to ensure accuracy of tax filing. V iolation of any these tax laws is defined as a tax crime and is punishable by law. 3 jalan 9 10 seksyen 9.

Kuala lumpur sept 30 datin seri rosmah mansor s money laundering and tax evasion trial involving rm7 097 750 will begin after the completion of her ongoing corruption case involving the solar hybrid project for rural schools in sarawak. Datin seri rosmah mansor is pictured at the kuala lumpur high court september 8 2020. Calculations rm rate tax rm 0 5 000.

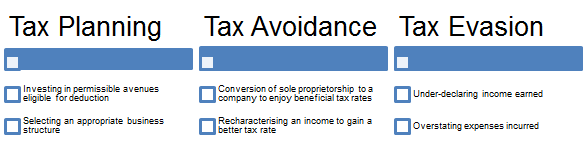

Tax evasion is a criminal offence which involves deliberately misrepresent the true state of their affairs to the tax authorities to reduce their tax liability and includes dishonest tax reporting such as declaring less income profits or gains than the amounts actually earned or overstating deductions. Among these studies we can point to the study of kasipillai et al. This might be underreporting income inflating deductions without proof hiding or not reporting cash transactions or hiding money in offshore accounts.

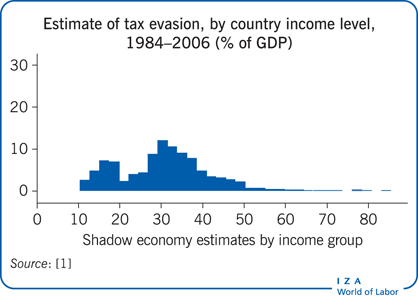

2000 estimated the size of hidden income and tax evasion for malaysia. Lembaga hasil dalam negeri malaysia level 3 menara 2 no. And that could make you a candidate for a tax audit to verify your tax returns.

On the first 5 000 next 15 000. According to lhdn you can be audited for up to 5 years of assessment and there is no time limit on the audit if there is fraud or tax evasion so you ll want to make sure your tax accounts are in order. In another study kasipillai et al.

Tax evasion on the other hand is using illegal means to avoid paying taxes. The following table is the summary of the offences fines penalties for each offence. The aim of tax investigations is to investigate taxpayers who are suspected to be involved in fraud wilful defraud or negligence in reporting their income.

Investigated the phenomena of tax evasion for malaysia.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)