Tax Evasion Cases In Malaysia

Tax evasion and trust fund taxes.

Tax evasion cases in malaysia. On oct 4 2018 rosmah had pleaded not guilty in the sessions court here to 12 counts of money laundering involving rm7 097 750 and five counts for failing to declare her income to the inland revenue board. 2003 that investigated the influence of education on tax avoidance and tax evasion by using questioner method. Kuala lumpur may 18 the hearing of datin seri rosmah mansor s case for money laundering and tax evasion involving rm7 097 750 which was set for this month has been vacated to make way for her ongoing corruption trial involving the solar hybrid project for rural schools in sarawak.

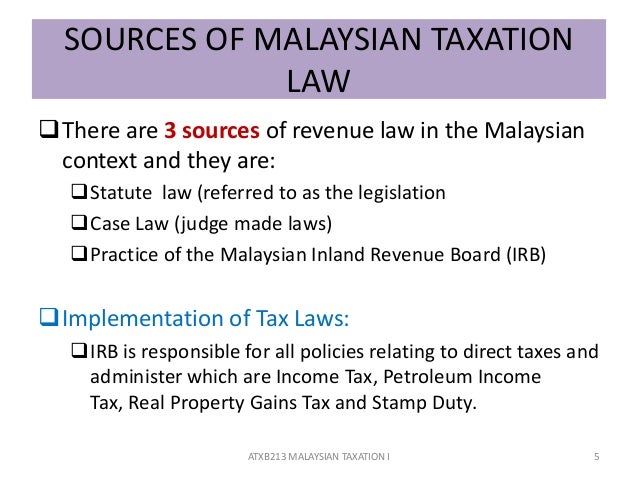

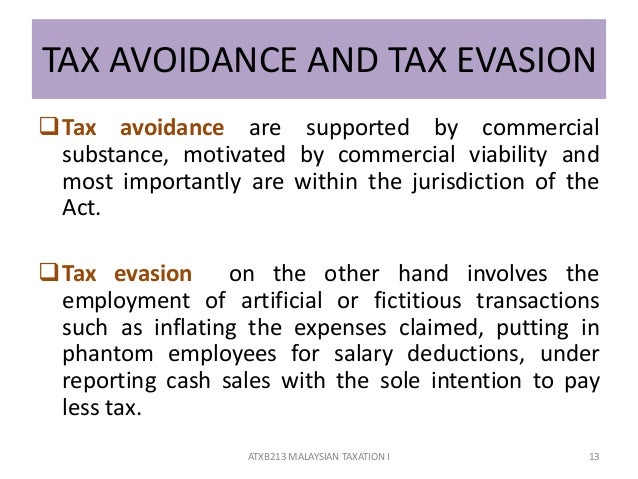

Tax evasion is a criminal offence which involves deliberately misrepresent the true state of their affairs to the tax authorities to reduce their tax liability and includes dishonest tax reporting such as declaring less income profits or gains than the amounts actually earned or overstating deductions. 2000 estimated the size of hidden income and tax evasion for malaysia. Additional assessments irbm will further investigate your expenditure and income.

Investigated the phenomena of tax evasion for malaysia. Previously the court had vacated the hearing of rosmah s case for money laundering and tax evasion which was earlier fixed to begin in may to give priority to the solar hybrid trial. Among these studies we can point to the study of kasipillai et al.

In another study kasipillai et al. In the case of detection of tax offence such as fraud wilful defraud or negligence the irbm is empowered to conduct.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)