Tax Computation Format Malaysia

2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

Tax computation format malaysia. To submit the income tax return form by the due date. Individuals partnerships form be resident individuals who do. Basic format of tax computation for an investment holding company pdf 497kb basic format of tax computation for a shipping company xls 105kb basic format of tax computation for a development and expansion incentive dei.

You may refer to the following templates for guidance on how to prepare your tax computation for specific industries. Tax rate of company. To compute their tax payable.

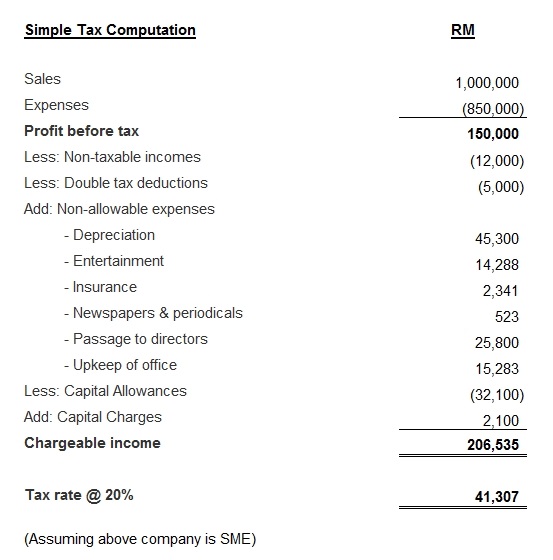

Corporate income tax in malaysia is applicable to both resident and non resident companies. An example of the computation for percentage of income from the holding of investments is as follows. Example of tax computation format would be.

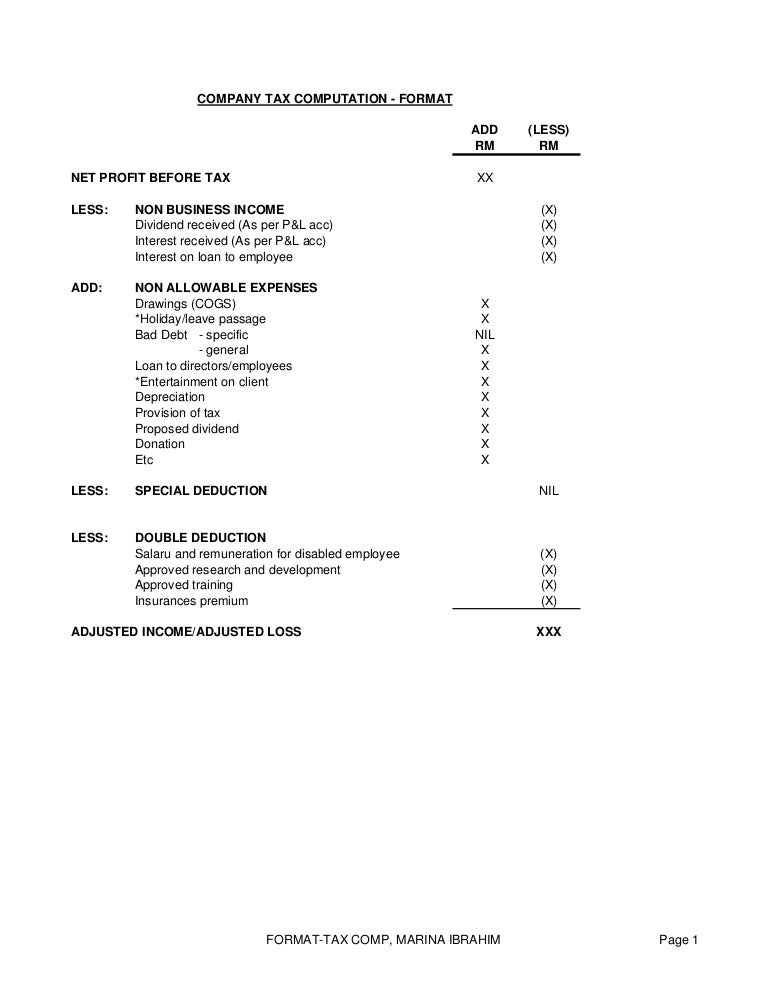

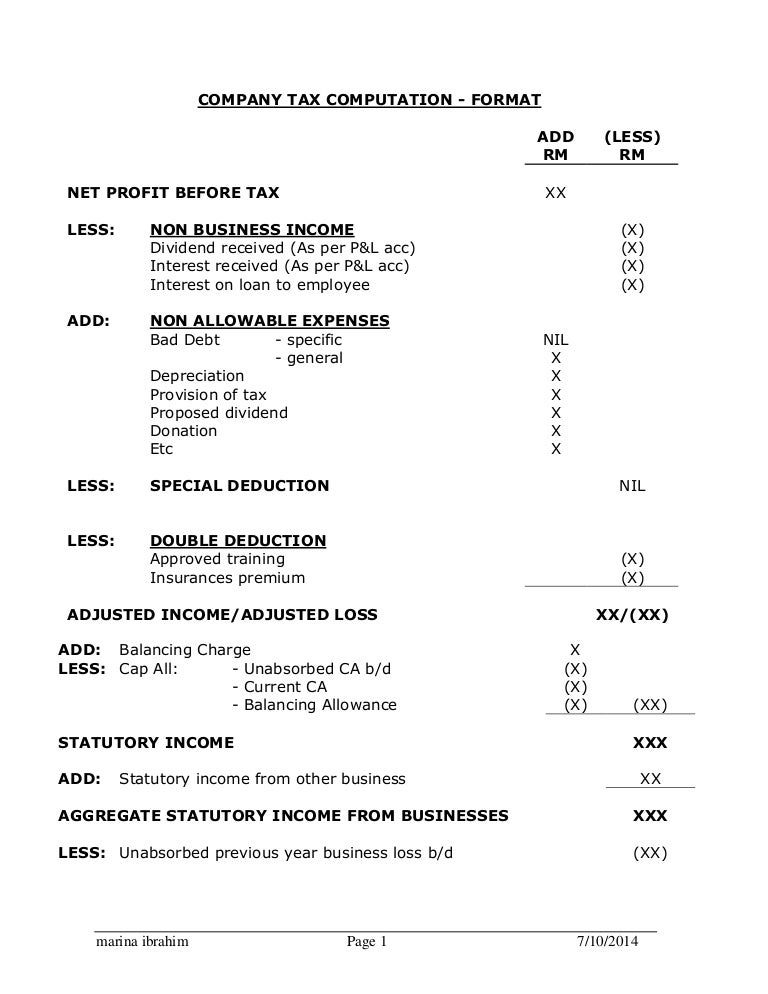

Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add. Company tax computation format 1. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Tax treatment for investment holding company listed on the bursa malaysia 15 10. To check and sign duly completed income tax return form. Husband and wife have to fill separate income tax return forms.

Form type taxpayer year of assessment deadline extended deadline by e filing a. Companies are taxed at the 24 with effect from year of assessment 2016 while small scale companies with paid up capital not exceeding rm2 5 million are taxed as follows. Income attributable to a labuan business.

Capital allowance industrial building allowance 21 11. Employers form e employers ya 2019 31 march 2020 31 may 2020 b. Tax treatment 8 8.

Updates and amendments 22. Lhdn tax filing deadline extension updated 28 april 2020. Company tax computation format add less rm rm net profit before tax xx less.

Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x. Income tax return form on conviction rm200 to rm20 000 or imprisonment or both failure to furnish income tax return form no prosecution instituted 300 of tax payable make an incorrect tax return by omitting or understating any income on conviction rm1 000 to rm10 000 and 200 of tax undercharged make an incorrect tax return by omitting or.