Tax Computation For Sole Proprietor In Malaysia

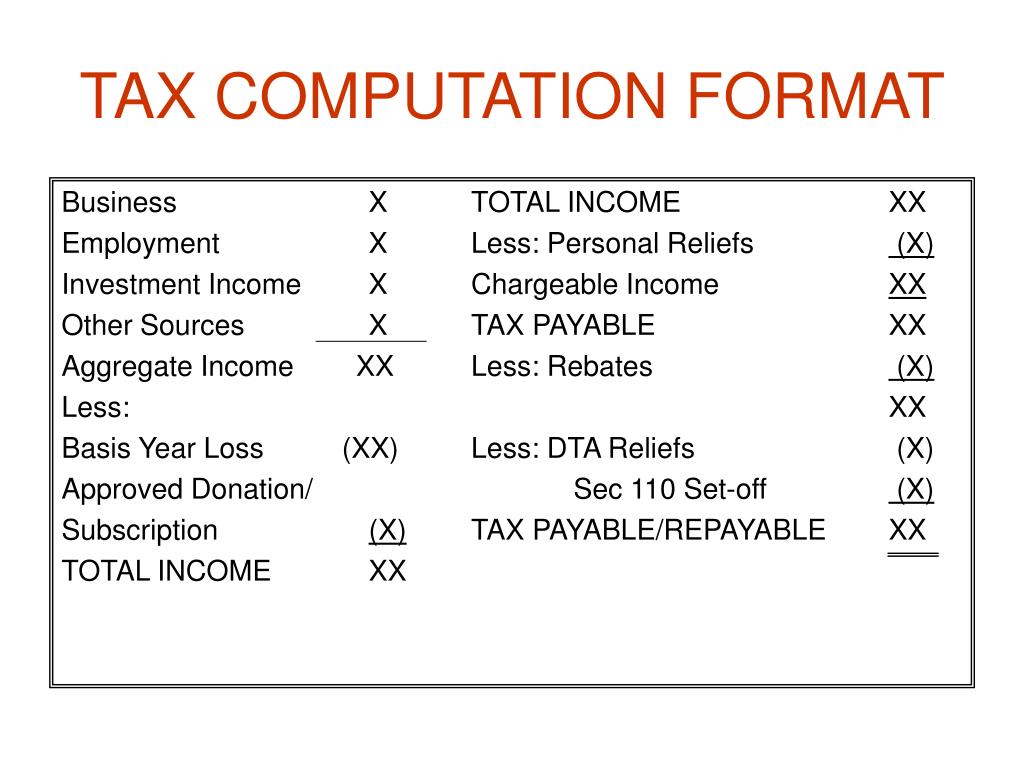

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax.

Tax computation for sole proprietor in malaysia. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Examples of direct tax are income tax and real property gains tax. If did not how to prepare go to find tax agent to help you.

Companies should prepare their tax computations annually before completing the form c s c. Husband and wife have to fill separate income tax return forms. The tax is paid directly to the government.

A sole proprietor or a partner in a partnership are also entitled to personal reliefs same as employed individuals. Tax submitted in 2017 is for 2016 income. If you have received full time or part time income from trade business vocation or profession you are considered a self employed person.

Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. A direct tax is a tax that is levied on a person or company s income and wealth. This page shows the relevant information to help you prepare and file your tax return.

This means that low income earners are imposed with a lower tax rate compared to those with a higher income. Imoney has a useful guide about taxes made up of 11 short chapters. All supporting documents like business records cp30 and receipts need not be submitted with form p.

You have to report this income in your tax return. You need to declared your income in form b. To compute their tax payable.

To submit the income tax return form by the due date. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. The system is thus based on the taxpayer s ability to pay.

You make payment on income generated the previous year i e. Sole proprietor need to declared his income tax what you need to do now is prepared full set account perform tax computation and capital allowance schedule the due date is 15 july if you using e filling. However business related deductions and personal reliefs must be separated and must be claimed in its rightful category e g.

All profits and losses go directly to the business owner. Thereby no separate tax return file is needed sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26. Mobile phone purchased for own use to be claimed under personal lifestyle restricted to rm2 500 and not under business expense.

According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn.

%202.png)