Tax Avoidance In Malaysia

The agreement shall apply also to any identical or substantially similar taxes that are imposed after the date of signature of the agreement in addition to or in place of the existing taxes.

Tax avoidance in malaysia. It discusses the decision of the court of appeal in a recent tax case and the questions on the parameter of legitimate tax planning. Tax avoidance this alert talks about the delicate issue of tax avoidance under section 140 of the income tax act 1967. Dta malaysia india 3 b in malaysia.

Hereinafter referred to as malaysian tax. Singapore and the government of malaysia for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. Thus in most tax jurisdictions anti avoidance provisions are included in the tax laws to defeat or pre empt anticipated avoidance schemes mischief or to plug loopholes that have come to light.

The australian position is similar to malaysia. If the dominant purpose of a transaction has no commercial purpose then that transaction will be disregarded or varied as being for the purpose of tax avoidance by tax authority there. Pwc alert issue 116.

I the income tax. However this particular section is far from perfect to deal with tax avoidance issue. From the perspective of revenue authorities it is equally important to counter tax avoidance.

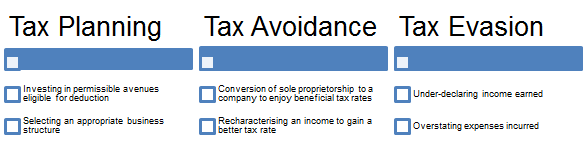

Income tax in malaysia is imposed on income accruing in or derived from malaysia resident and business. Tax avoidance is the legitimate minimizing of taxes and maximize after tax income using methods included in the tax code. In malaysia by virtue of s 140 1 the dgir is entitled to disregard or vary any transaction that is created merely for the purposes of tax avoidance.

In malaysia income tax act contains general and specific anti avoidance provision which empowers the director general to disregard schemes that are not commercially justified or are merely set up to avoid tax despite their legal form. One thing worth mentioning is malaysia has an extensive number of double tax treaties available for the avoidance of double taxation. In the remaining parts of the article i will discuss examples of cases that would highlight the good the bad and the ugly of section 140 of the act.

Section 140 of the act is indeed an anchor provision concerning tax avoidance. Although tax avoidance is acceptable in the eyes of law in malaysia the tax authority taken an extreme change of stance since 2010 and triggered section 140 of the malaysia income tax act more often that it does historically. Businesses avoid taxes by taking all legitimate deductions and tax credits and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the internal revenue code or state tax codes.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)