Stamping Office In Kl

Stamp duties are imposed on instruments and not transactions.

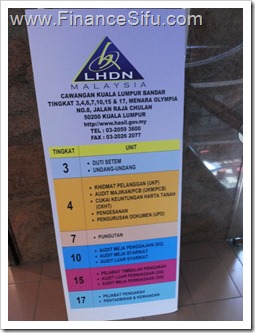

Stamping office in kl. Level 3 4 6 7 10 15 17 menara olympia no. Finally once the stamp office satisfied with the documents and information given they will approve and issue a letter stated the stamp duty is exempted. The normal stamp duty is around rm20 00.

You may pay on the spot. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. 360 jalan tuanku abdul rahman 50100 kuala lumpur malaysia tel.

8 jalan raja chulan 50200 kuala lumpur. Stamp office will check and verified all the information and make sure you fulfill the criteria. Get these agreements stamp the inland revenue board or jabatan hasil dalam negeri in your area.

The lhdn kuala lumpur bandar also to act as agent of the government and to provide services in administering assessing collecting and enforcing payment of income tax petroleum income tax real property gains tax estate duty stamp duties and such other taxes as may be agreed between the government and the board. Immediately after the stamping fee is paid the document will passed to another officer just beside it. About e stamping portal this application is a service of the singapore government.

03 2059 3600 fax. 7 30 am 5 30 pm. 20 01 20 02 20 03 level 20 menara centara no.

However for kulim branch you will need to buy the stamp hasil from pos office first before going to kulim lhdn office. E stamping is a secured portal for you to view and manage your stamp duty transactions with iras at your convenience. Monday friday.

03 2272 3226. 3e accounting malaysia is offering affordable pricing for company incorporation and formation services in selangor kuala lumpur malaysia. The officer will checks the document and passes it to a guy who operates a stamping machine.

In malaysia stamp duty is a tax levied on a variety of written instruments specifies in the first schedule of stamp duty act 1949. Contact info unit no. 9 am to 6 pm.

There are two types of stamp duty namely ad valorem duty and fixed duty. An instrument is defined as any written document and in general stamp duty is levied on legal commercial and financial instruments. Prepare two 2 copies of the tenancy agreement.

Lhdn kuala lumpur bandar branch. Stamp office will issue a letter requiring you to pay the stamp duty. In general term stamp duty will be imposed to legal commercial and financial instruments.