Stamp Duty Malaysia 2018

In malaysia stamp duty is a tax levied on a variety of written instruments specifies in the first schedule of stamp duty act 1949.

Stamp duty malaysia 2018. 20 of the monthly rent. June 2018 is the fy ending 30 june 2018. Stamp duty exemption on contract notes for sale and purchase transaction of structured warrant or exchange traded fund approved by the securities commission executed from 1 january 2018 to 31 december 2020.

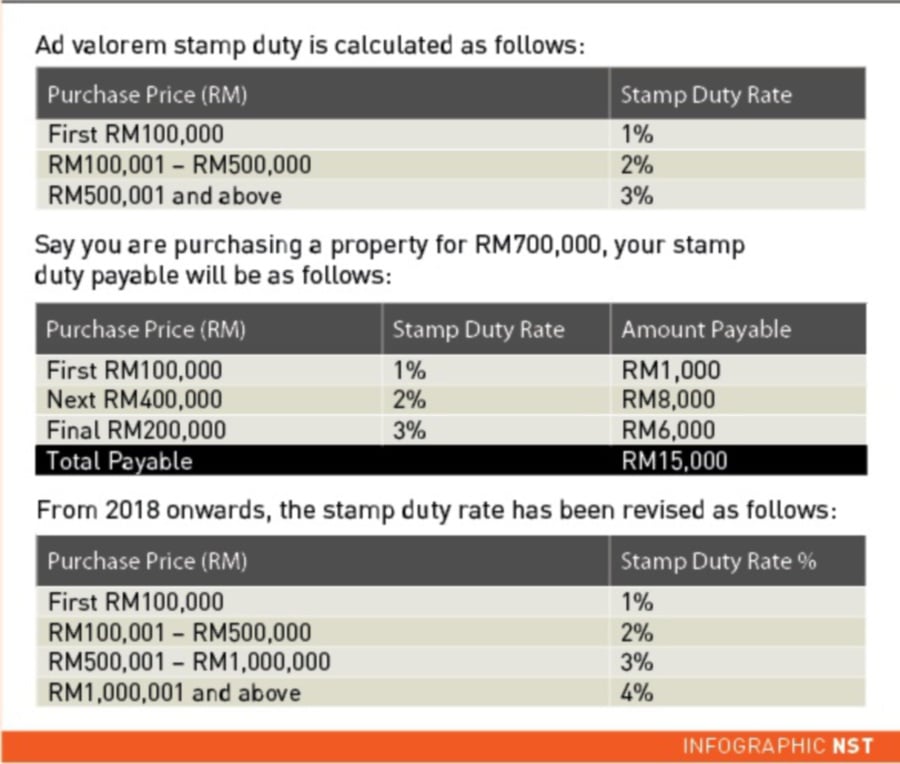

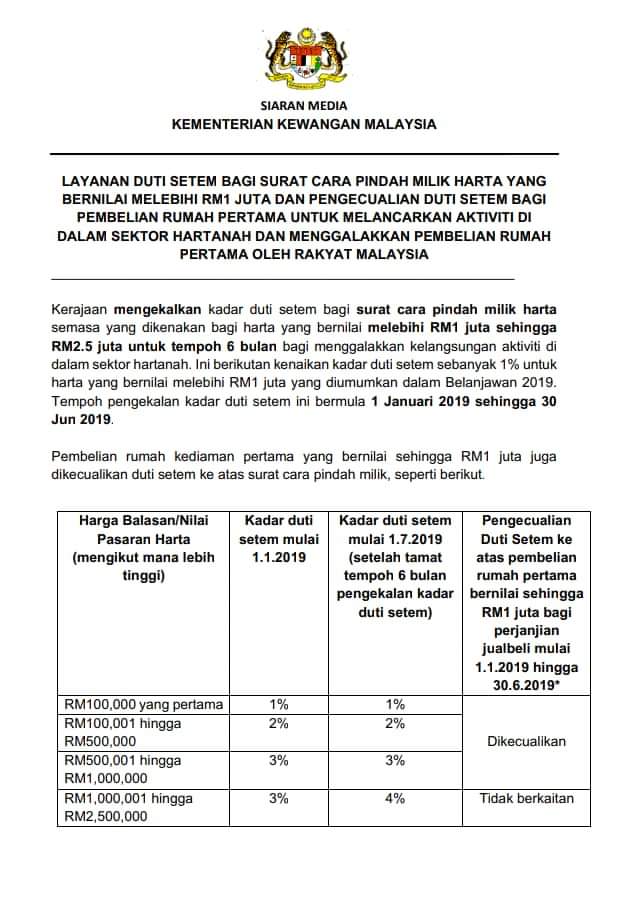

Malaysia adopts a self assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer. Rm100 001 to rm500 000 stamp duty fee 3. In general term stamp duty will be imposed to legal commercial and financial instruments.

I got the following table from the lhdn office. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia. There are two types of stamp duty namely ad valorem duty and fixed duty.

All income of persons other than a company limited liability partnership co operative or trust body are assessed on a calendar year basis. Malaysia taxation and investment 2018 updated april 2018 1 1 0 investment climate 1 1 business environment malaysia is a federated. Stamp duty fee 1.

5 5 stamp duty 5 6 customs and excise duties 5 7 environmental taxes 5 8 other taxes 6 0 taxes on individuals 6 1 residence. Rm500 001 and rm1 000 000 stamp duty fee 4. Venus lim may 25 2018 at 3 03 pm reply.

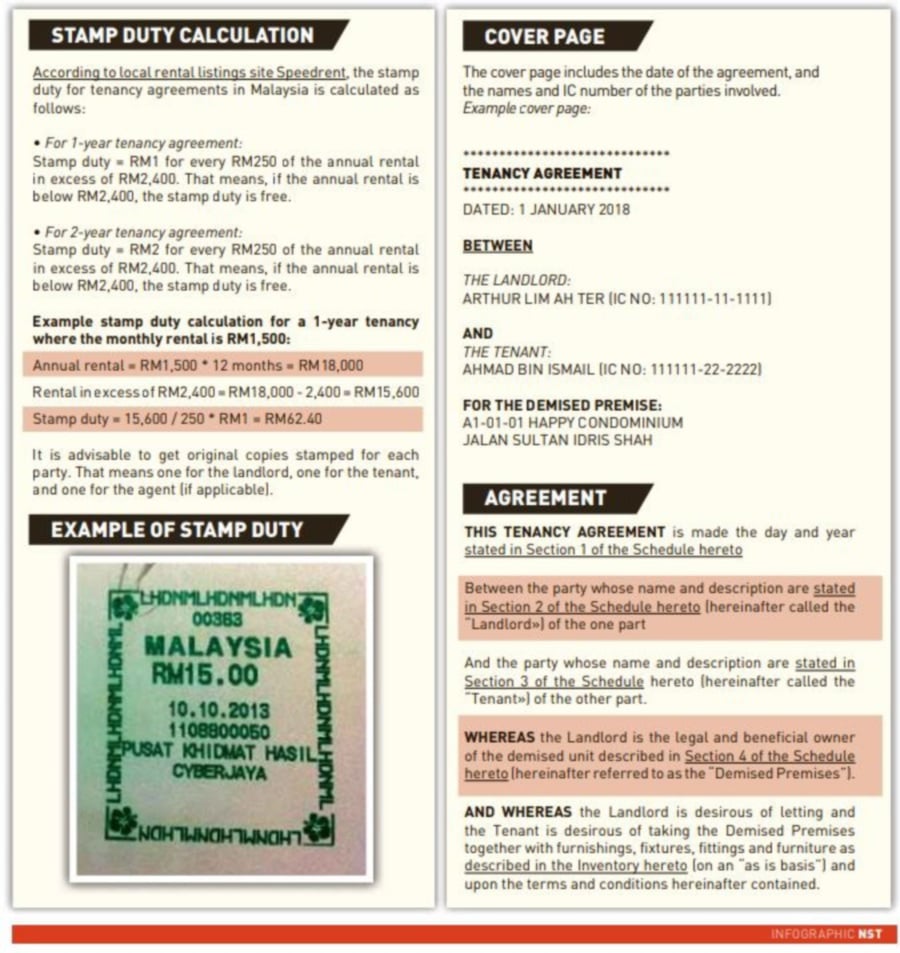

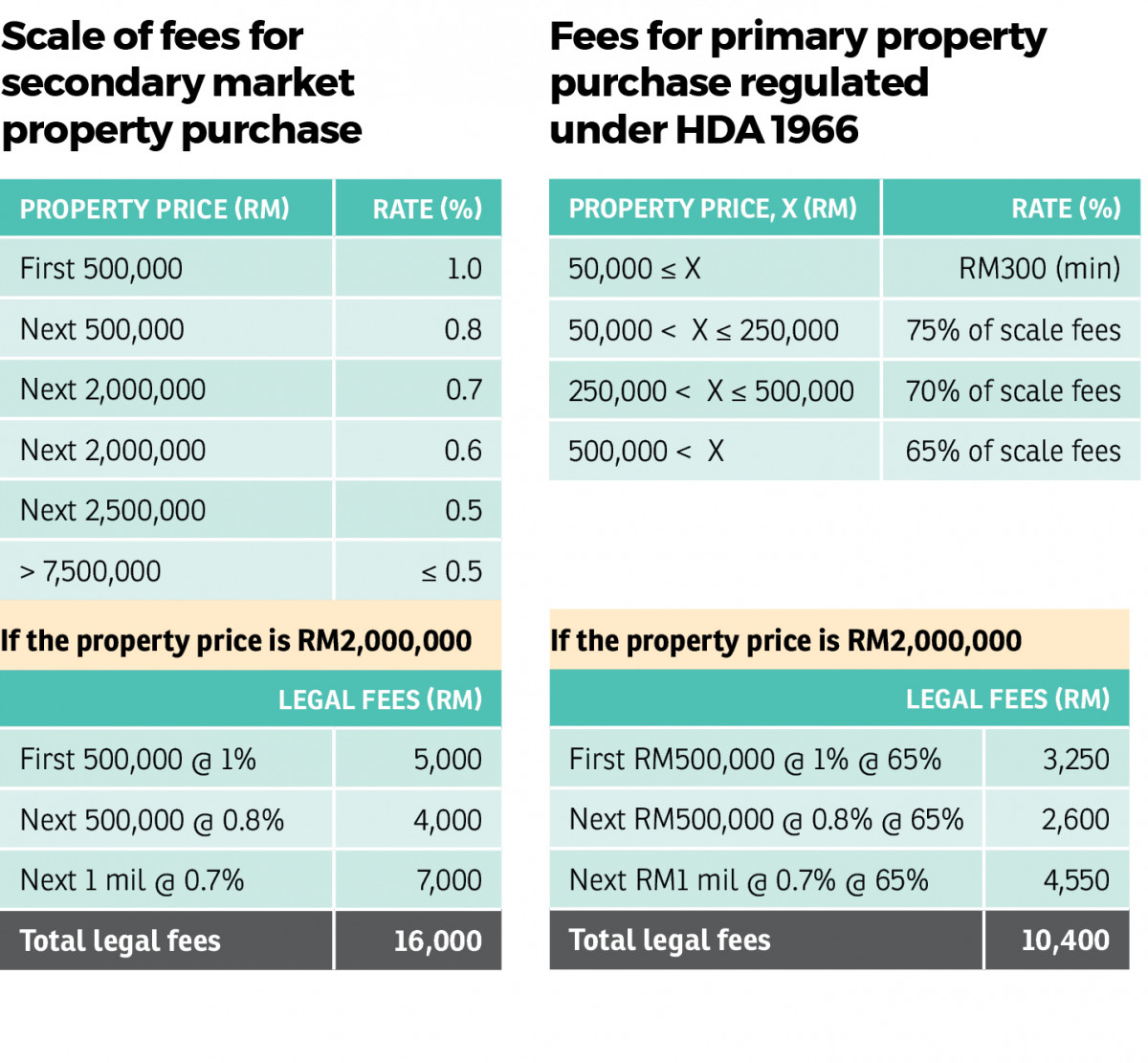

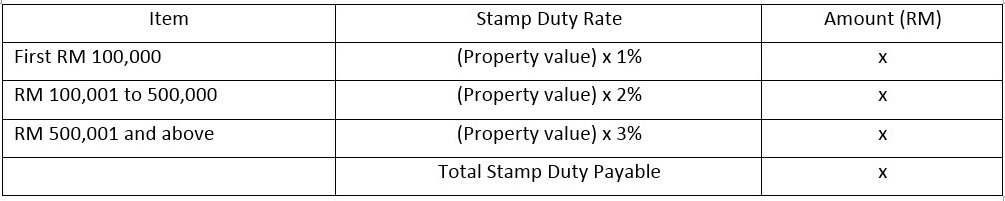

In summary the stamp duty is tabulated in the table below. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Next rm 90 000 rental.

Disbursement fees to be ranging of rm1000 rm1500 00 based on estimation for first time house buyer you can check for the latest. Professional legal fees to be included 6 of sst. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949.

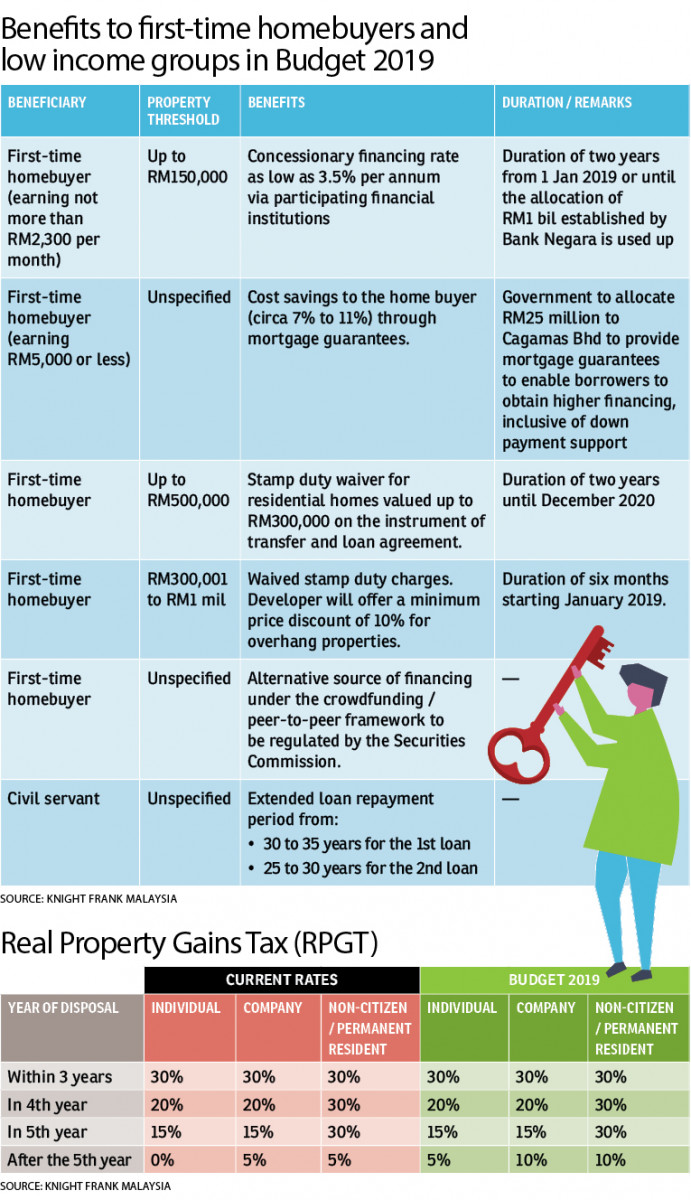

For first rm100 000 stamp duty fee 2. 25 of the monthly rent. Hi i m buying my first house for 301k after 5months of wait the lawyer said my request has been rejected because the property is above 300k.

2014 2018 chat property malaysia. More tha rm 100 000.