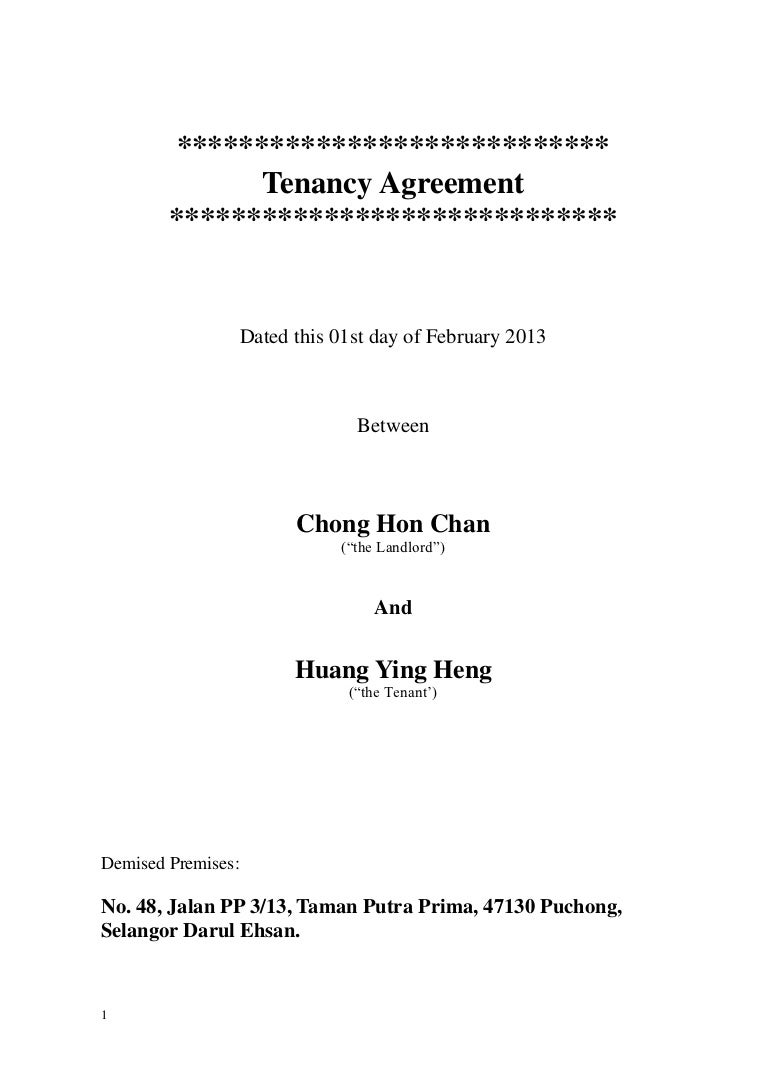

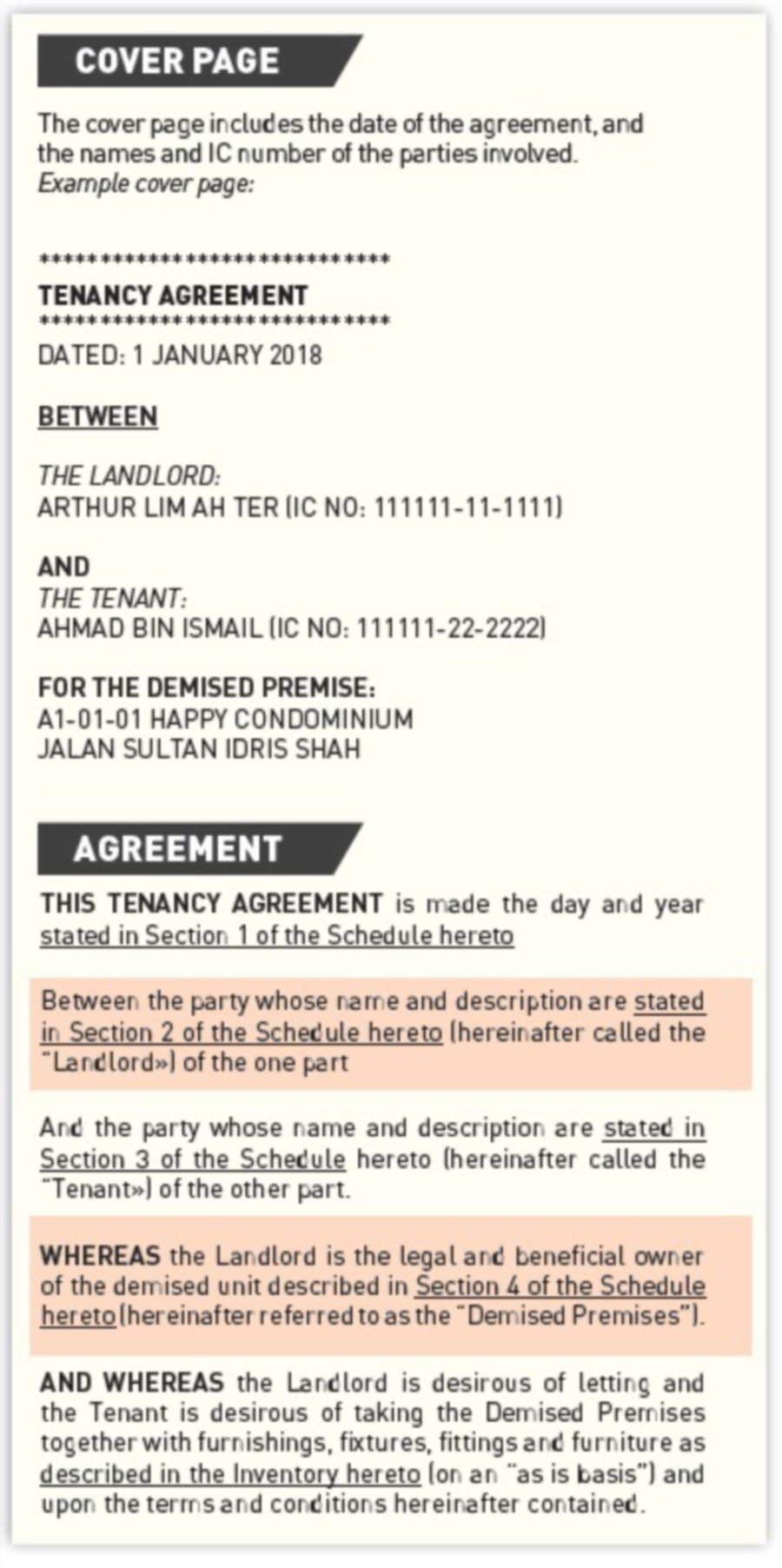

Stamp Duty For Tenancy Agreement Malaysia

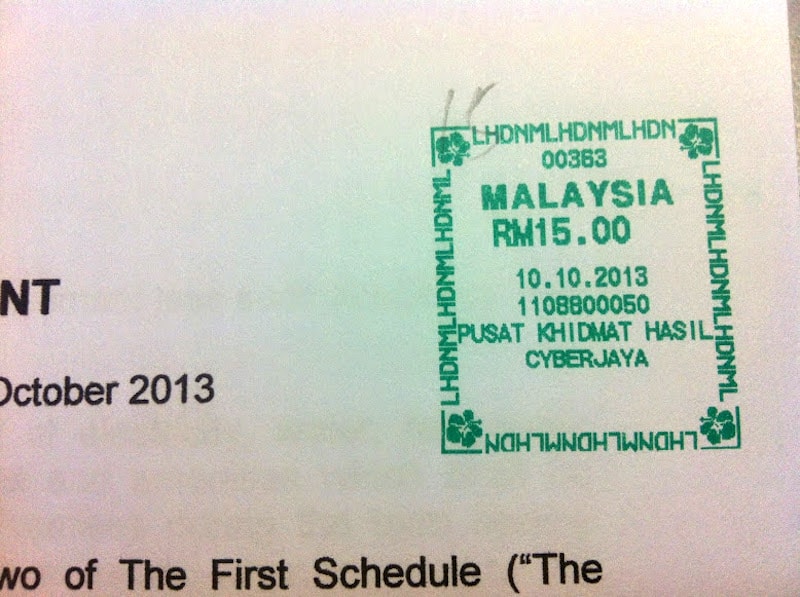

This method will replace the manual system in lhdnm s counter which use franking machine and revenue stamp.

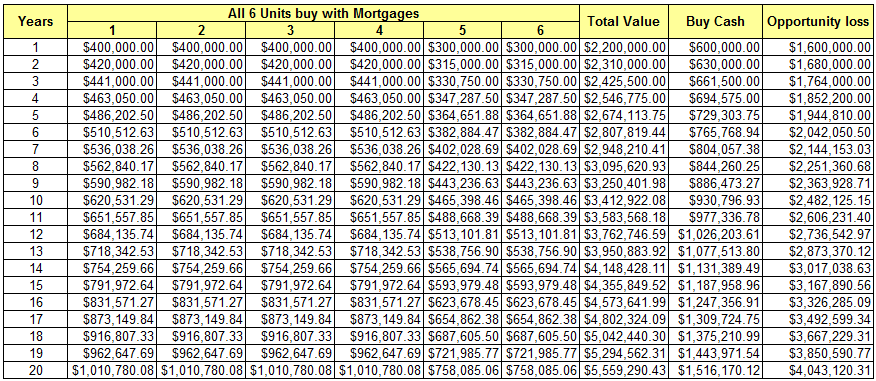

Stamp duty for tenancy agreement malaysia. Legal fee for tenancy agreement period of above 3 years. Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130. The formula for calculating that stamp duty will be.

For second copy of tenancy agreement the stamping cost is rm10. To use this calculator. Stamps is an electronic stamp duty assessment and payment system via internet.

As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Stamp duty is computed based on the consideration paid or the market value of the property whichever is the higher amount. How do i calculate the stamp duty payable for the tenancy agreement.

Stamp duty payable 0 4 of the rent for the extended period from 1 jan 2021 31 mar 2021. A lease with fixed rental is one for which a fixed rental is agreed upfront for the entire lease period. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949.

Rm500 billion in debt is the malaysian government bankrupt. Rm24 000 rm2 400 rm21 600. For instance the monthly rental for a one year tenancy is rm2 000 so the annual rent is rm24 000.

How to open trading and cds account for trading in bursa malaysia. Registered account if you perform e stamping frequently you may wish to sign up as a corppass user and enjoy additional features. In summary the stamp duty is tabulated in the table below.

First rm 10 000 rental 50 of the monthly rent. I got the following table from the lhdn office. All you need is a registered account with us.

Home calculators tenancy agreement stamp duty calculator. Pay seller s stamp duty or claim for seller s stamp duty remission for housing developers for agreements relating to disposal of properties. Next rm 90000 rental 20 of the monthly rent.

And if the tenancy agreement has been signed for more than 3 years the stamp duty rate will be rm3 for every rm250 of the annual rent in excess of rm2 400. Tenancy agreement stamp duty calculator. Lease or tenancy agreement.

Tenancy period 3 years payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4. Lease with fixed rent. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the.