Stamp Duty For Tenancy Agreement Malaysia 2020

Total stamp duty is rm5000.

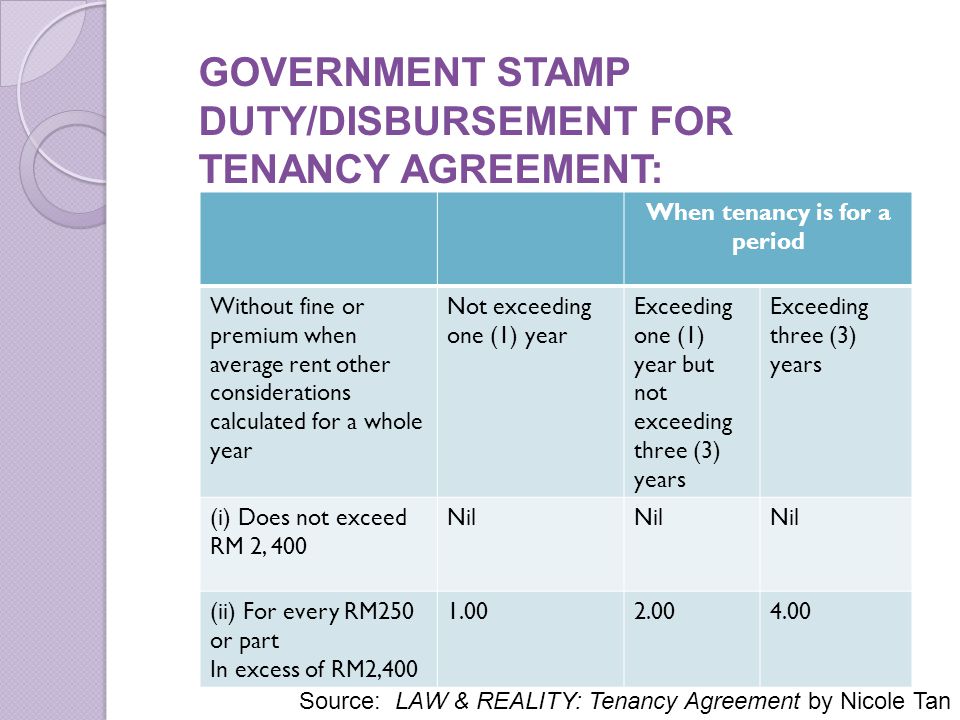

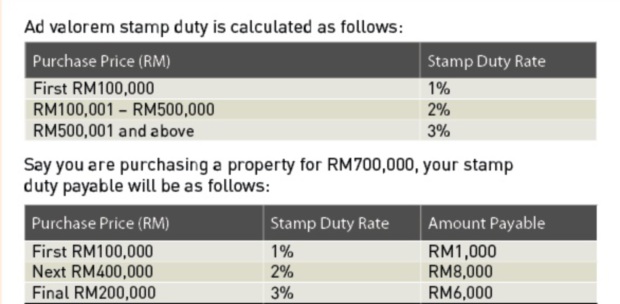

Stamp duty for tenancy agreement malaysia 2020. Stamp duty is computed based on the consideration paid or the market value of the property whichever is the higher amount. Rm100 001 to rm500 000 stamp duty fee 3. Next rm 90000 rental 20 of the monthly rent.

Rm500 001 and rm1 000 000 stamp duty fee 4. For first rm100 000 stamp duty fee 2. Pay seller s stamp duty or claim for seller s stamp duty remission for housing developers for agreements relating to disposal of properties.

Tenancy agreement stamp duty calculator. Legal fee for tenancy agreement period of above 3 years. Home calculators tenancy agreement stamp duty calculator.

Rm500 billion in debt. Lease or tenancy agreement. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia.

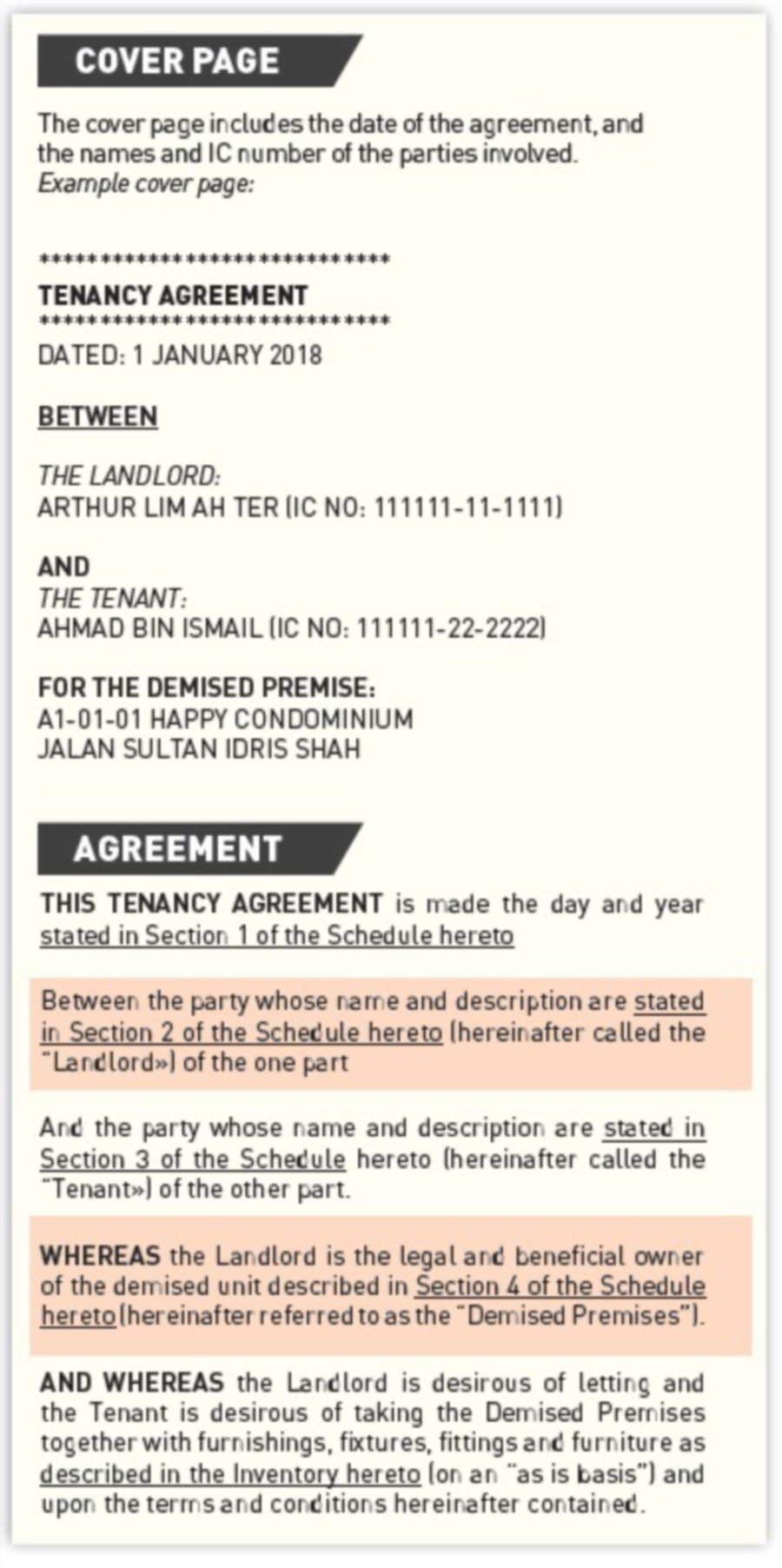

Tenancy agreement i s a printed document that states all the terms and conditions which the tenants and landlords have agreed upon before the tenant moves in. Stamp duty exemption on contract notes for sale and purchase transaction of structured warrant or exchange traded fund approved by the securities commission executed from 1 january 2018 to 31 december 2020. Sale and purchase agreement malaysia.

Rm100 000 x 1 rm1000. Sale purchase of property seller s stamp duty note. Stamp duty calculation malaysia 2020 stamp duty exemption malaysia 2020 the first example if the property purchase price or property value is rm300 000 the property stamp duty will be as follows.

From rm100 001 to rm200 000 2 rm200 000 x 2 rm4 000. How to open trading and cds account for trading in bursa malaysia. All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess.

2020 stamp duty scale from 1st july 2019 stamp duty fee 1. Stamp duty payable 0 4 of the rent for the extended period from 1 jan 2021. 1 jun 2020 30 nov 2020 6 month lease where lease start date was brought forward to 1 apr 2020 1 apr 2020 30 sep 2020.

Lease with fixed rent. It is very crucial for property leasing in order to protect the landlords and tenants. For the first rm100 000 1.

First rm 10 000 rental 50 of the monthly rent. The stamp duty fee for the first rm100 000 will be 100 000 1 rm1 000 the stamp duty fee for the remaining amount will be 300 000 100 001 2 rm4 000. More than rm 100 000 negotiable q.

Importance of tenancy agreement stamping. Return form rf filing programme for the year 2020 amendment 1 2020 return form rf filing programme for the year. An instrument is defined as any written document and in general stamp duty is levied on.

How do i calculate the stamp duty payable for the tenancy agreement.