Stamp Duty Exemption Order Malaysia

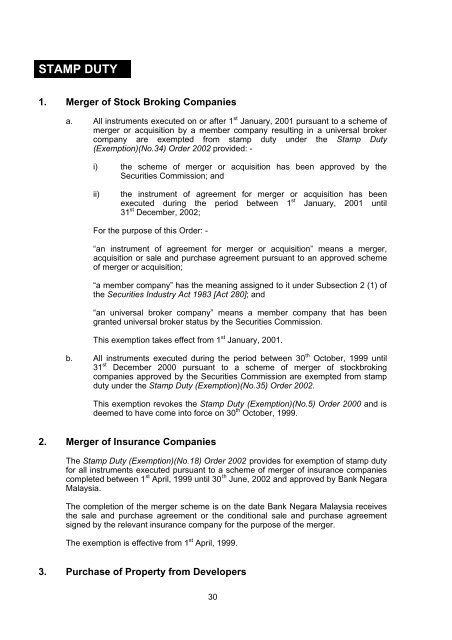

Stamp duty fee 1.

Stamp duty exemption order malaysia. Valid until 31st december 2020 you can pass down this stamp duty remission order to your lawyer if he is unaware of the exemption for stamp duty. Sale and purchase agreement malaysia. Stamp duty calculation malaysia 2019 and stamp duty malaysia exemption stamp duty malaysia 2019 commonly asked questions.

Here are a few stamp duty remission order for first home buyers. However the property developer must offer a 10 discount on selling prices to qualify under the hoc campaign. Request a free quotation from us today guaranteed reply.

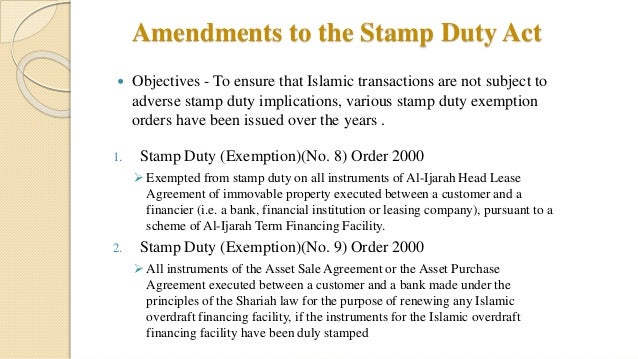

As stamp duty remission no. Stamp duty exemption for first time house buyer 2019 stamp duty legal fees for purchasing a house 2020. The exemptions under stamp duty exemption no 6 order 2018 and stamp duty exemption no 7 order 2018 only apply where a purchaser or co purchaser is an individual who is a malaysian citizen.

Rm7000 the actual. Stamp duty malaysia 2020 new updates. Year 2002 stamp duty order remittance p u a 434 year 2003 stamp duty order exemption p u a 58 year 2007 stamp duty order exemption.

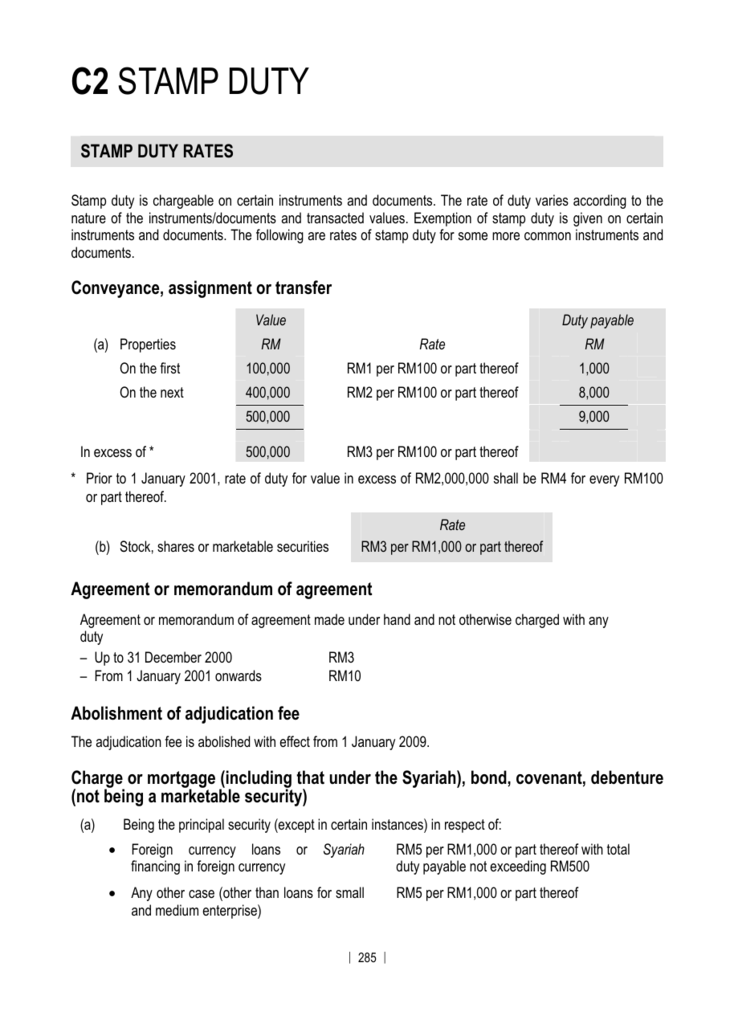

The exemption on the instrument of transfer is limited to the first rm1million of the property price and the stamp duty will be charged rm3 for every rm100 of the balance property price which is more than rm1million. The actual calculation of stamp duty is before first time house buyer stamp duty exemption. Rm100 001 to rm500 000 rm6000 total stamp duty must pay is rm7 000 00 and because of the first time house buyer stamp duty exemption you only need to pay.

In view of the stamp duty exemption orders and subject to the fulfilment of the conditions once the spa has been executed it will be stamped with the nominal stamp duty i e. Within 1 working days quotation for. This applies for buyers of properties priced between rm300 000 to rm2 5 million with the fee exemption applicable to the first rm1 million.

Is first time house buyer stamp duty exemption applicable to soho sovo sofo and service apartment property. The stamp duty exemption is for stamp duty on the first rm300 000 property value and loan amount. Stamp duty waiver for first time house buyer.

Pay lower or no stamp duty fees to buy a new property. 2 order 2018 does not contain the aforesaid requirements it is arguable that the remission order is applicable where a purchaser is not an individual or a malaysian. For first rm100 000 rm1000 stamp duty fee 2.

Stamp duty exemption no 4 order 2020 the exemption of stamp duty with effective on 1 june 2020 for the residential property price between rm300 000 to rm2 5million.