Stamp Duty Exemption Malaysia

Stamp duty exemption on perlindungan tenang insurance policies and takaful certificates with a yearly premium contribution not exceeding.

Stamp duty exemption malaysia. Announced changes to stamp duty in malaysia in 2018 mean that first time buyers are now exempt from certain stamp duty charges. List of services eligible. Stamp duty exemption list mid small cap plcs for stamp duty exemption the stamp duty exemption will be applicable for trading of companies listed on bursa malaysia securities with a market capitalization ranging between rm200 million and rm2 billion as at 31 december 2019 for eligibility in 2020.

Stamp duty malaysia 2020 new updates. Year 2002 stamp duty order remittance p u a 434 year 2003 stamp duty order exemption p u a 58 year 2007 stamp duty order exemption. Stamp duty waiver for first time house buyer.

Is first time house buyer stamp duty exemption applicable to soho sovo sofo and service apartment property. Sale and purchase agreement malaysia. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020.

Within 1 working days quotation for. Request a free quotation from us today guaranteed reply. This exemption was confirmed in budget 2019 put forward by the malaysian government.

Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia securities berhad executed from 1 march 2018 to 28 february 2021. Stamp duty exemption on the merger and acquisition related instruments namely. Stamp duty exemption for first time house buyer 2019 stamp duty legal fees for purchasing a house 2020.

Stamp duty exemption no 4 order 2020 the exemption of stamp duty with effective on 1 june 2020 for the residential property price between rm300 000 to rm2 5million. Contracts or agreements for sale or lease of properties including land building machinery and equipment instrument of transfer and memorandum of understanding. The exemption on the instrument of transfer is limited to the first rm1million of the property price and the stamp duty will be charged rm3 for every rm100 of the balance property price which is more than rm1million.

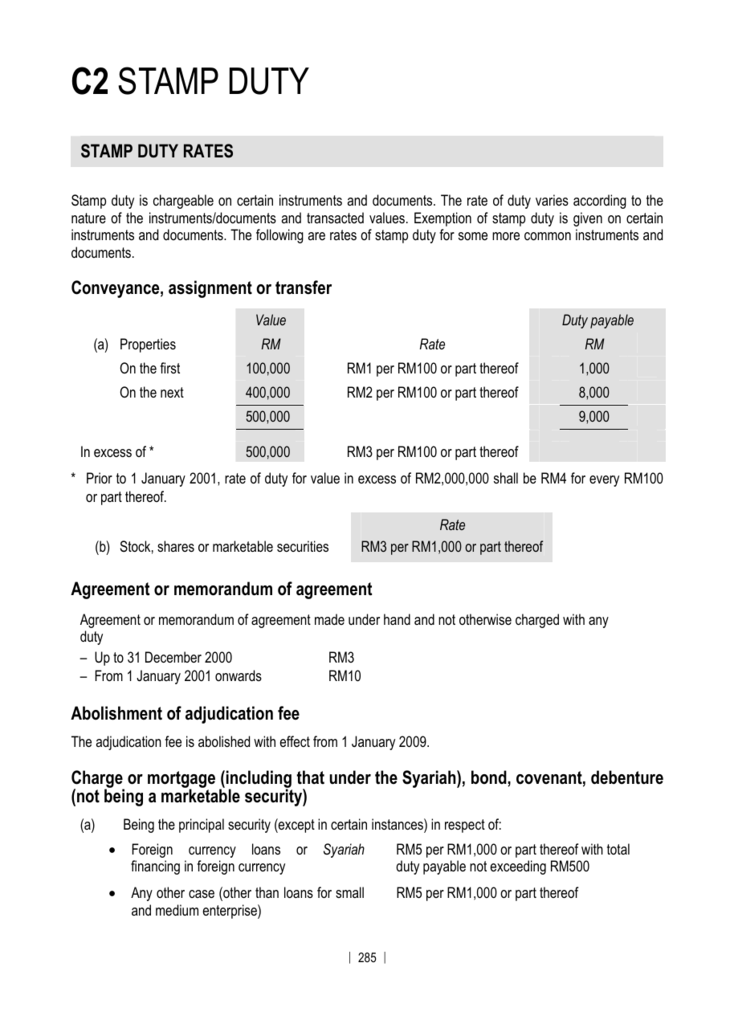

Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949.