Stamp Duty Exemption Malaysia 2017

Stamp duty exemption malaysia 2020.

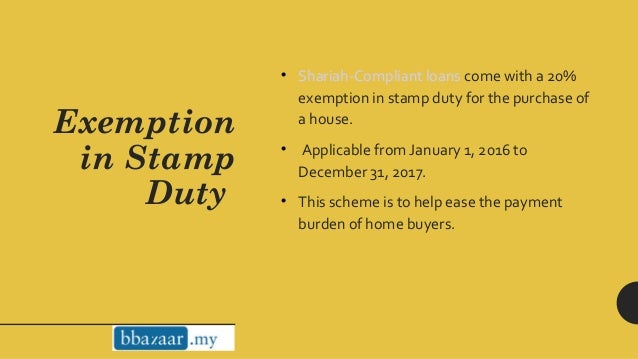

Stamp duty exemption malaysia 2017. Stamp duty exemption on perlindungan tenang insurance policies and takaful certificates with a yearly premium contribution not exceeding. That will be up to a maximum stamp duty exemption of rm5000. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia securities berhad executed from 1 march 2018 to 28 february 2021.

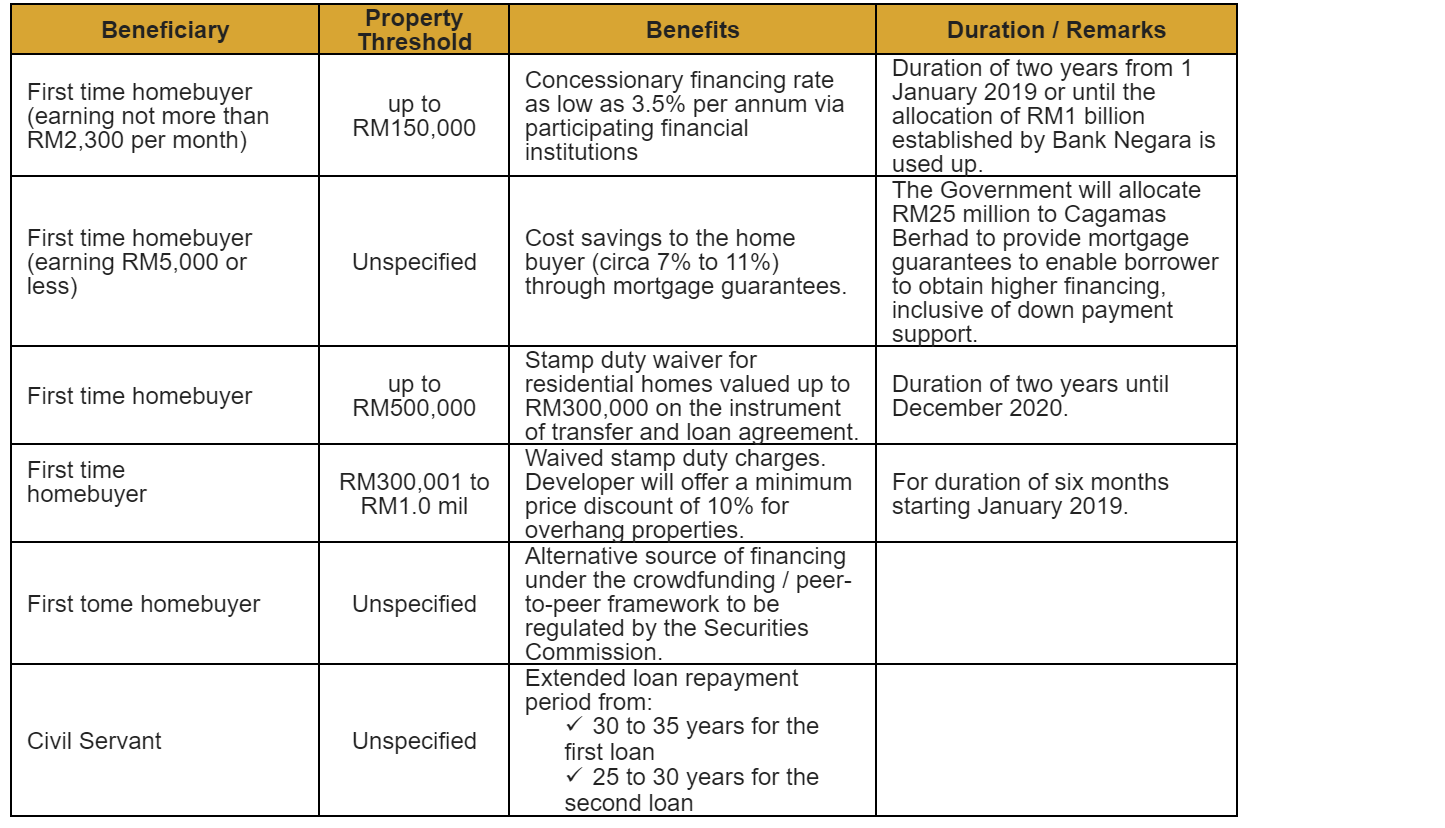

The stamp duty exemption is for the first rm300 000 property value stamp duty on the instrument of transfer. 1st january 2019 to 30th june 2020. Hi everyone this is an official media release from our finance minister on the stamp duty exemption 2019.

Stamp duty exemption on instruments of transfer of businesses assets or real properties acquired for instruments executed from 1 january 2013 but not later than 31 december 2017. The stamp duty exemption will be applicable for trading of companies listed on bursa malaysia securities with a market capitalization ranging between rm200 million and rm2 billion as at 31 december 2019 for eligibility in 2020. Mid small cap plcs for stamp duty exemption.

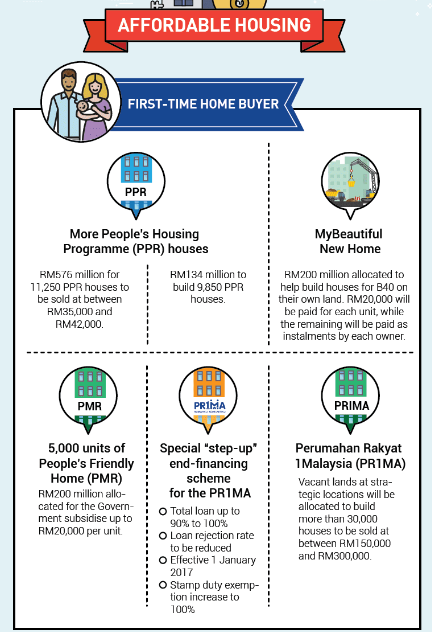

Prime minister datuk seri najib razak in tabling budget 2017 in parliament today said the current stamp duty exemption of 50 will be increased to 100. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020. The exemption on the instrument of transfer is limited to the first rm1 million of the home price while full stamp duty exemption is given on loan agreement effective for sales and purchase.

The stamp duty exemption 2020 is given to first home buyers that purchasing a property worth rm500 000 and below. The disposer of real properties or shares in rpcs to bt is given rpgt exemption for disposal of real properties or shares in rpcs from 1 january 2013 but not later than 31 december 2017. In an effort to reduce the cost of ownership of first home for malaysian citizens the government has proposed the following stamp duty exemptions effective date.

Exemptions relief from stamp duty. However this exemption is limited to homes valued up to rm300 000 for first homebuyers only and for purchases between jan 1 2017 and dec 31 2018. Hope this will clarify some issue regard to the stamp duty exemption 2019.