Stamp Duty Exemption 2019

Rm300 001 to rm500 000 purchase price stamp duty exemption only applicable after 1st july 2019.

Stamp duty exemption 2019. The exemptions under stamp duty exemption no 6 order 2018 and stamp duty exemption no 7 order 2018 only apply where a purchaser or co purchaser is an individual who is a malaysian citizen. Stamp duty exemptions and concessions. Compute the stamp duty payable including seller s stamp duty.

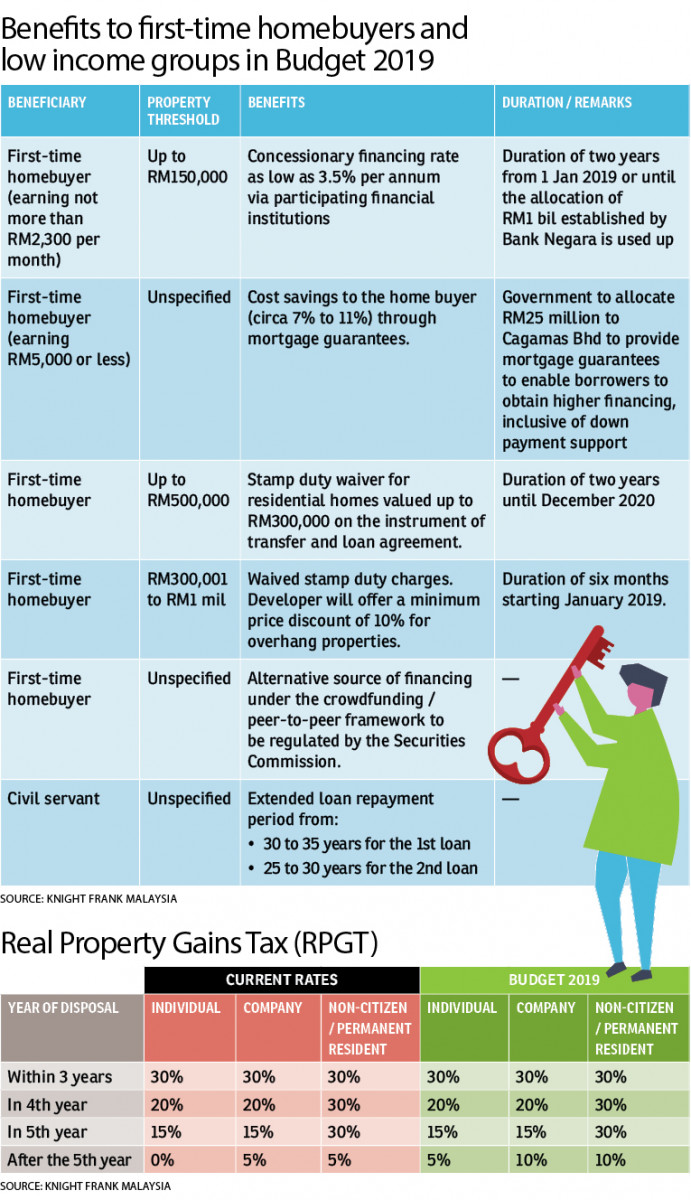

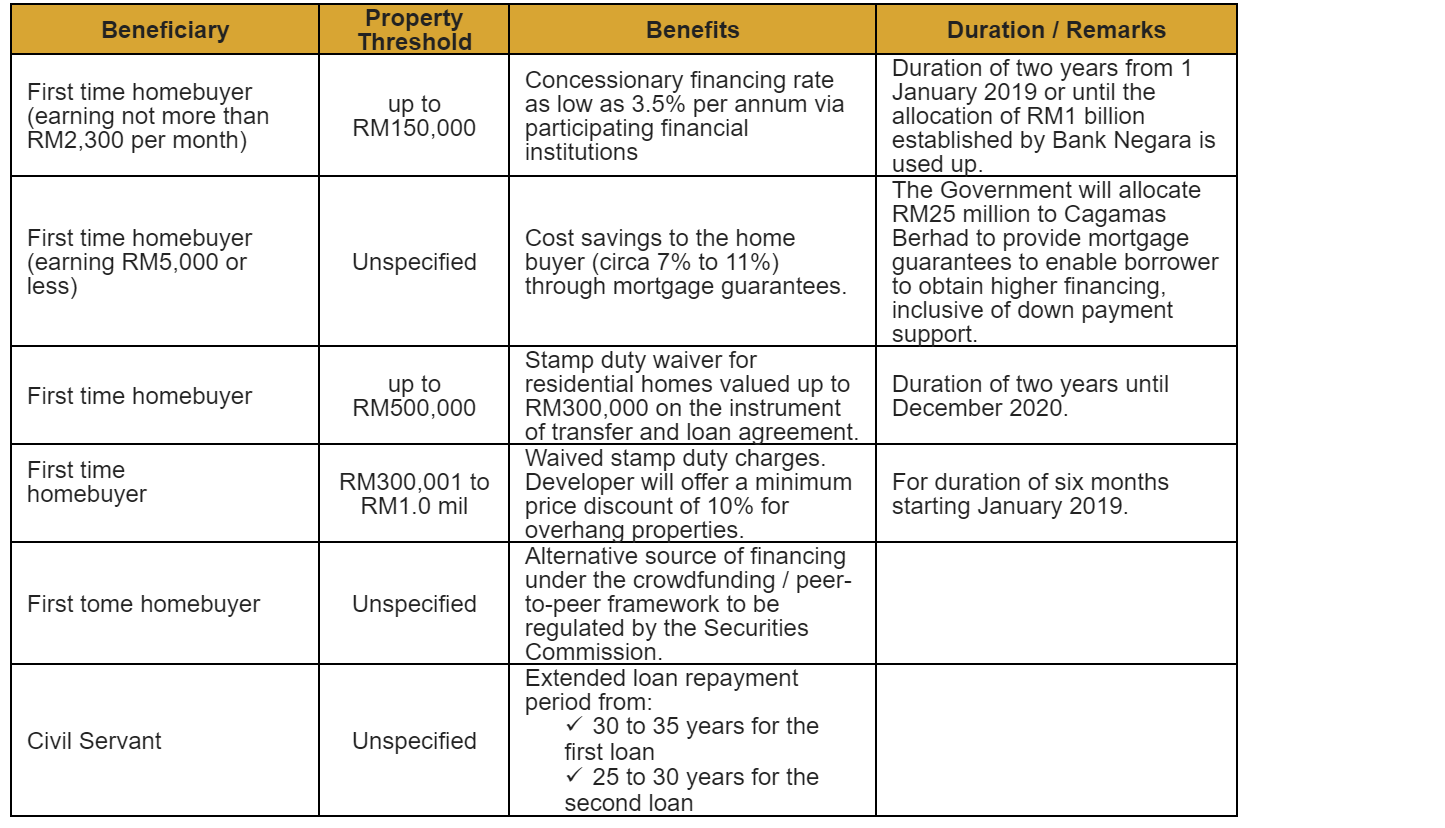

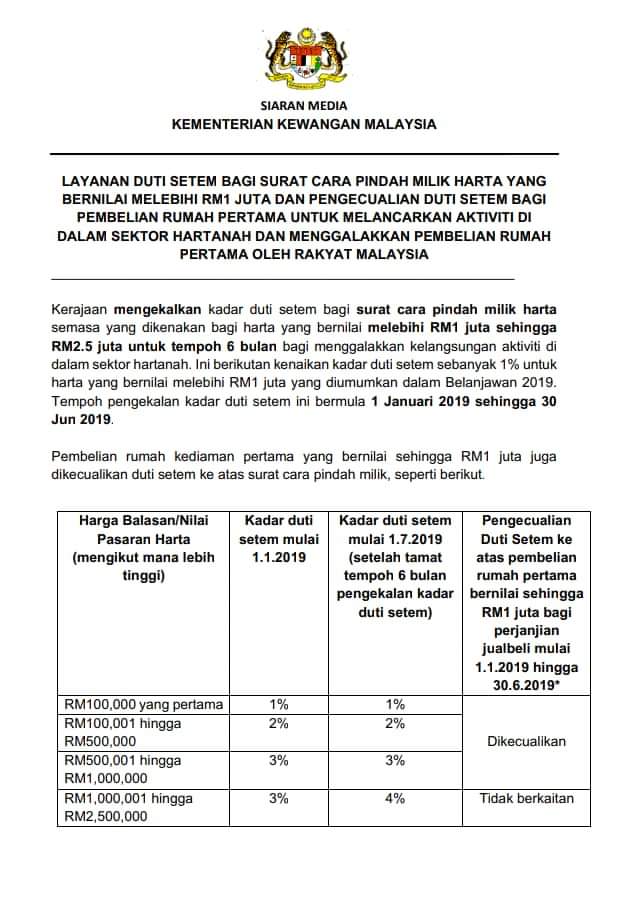

The nsw government has announced relief for people who lost their home in the 2019 20 nsw bushfires and who choose to buy in another location rather than rebuild. You must pay transfer duty once known as stamp duty in nsw when you buy. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020.

Reliefs and exemptions you may be eligible for stamp duty land tax sdlt reliefs if you re buying your first home and in certain other situations. 3 19 provides that any instrument of transfer for the purchase of a residential property under the nhoc 2019 which is valued at more than rm300 000 but not more than rm2 5 million and is executed by an individual is exempted from stamp duty in respect of rm1 million and below of the value of the residential property. These reliefs can reduce the amount of tax.

Do you think the good news stop here. Determine when your business is liable for gst registration for periods prior to 2019. Check eligibility for tax treaty exemption for personal services rendered by employees.

Like the stamp duty price calculation the rules are different in every state or territory. While it can be clearly stated that stamp duty is mandatory across the board there are a few concessions and exemptions that free a buyer from having to pay it. Stamp duty exemption no 3 order 2019 e o.

As stamp duty remission no. 2 order 2018 does not contain the aforesaid requirements it is arguable that the remission order is applicable where a purchaser is not an individual or a malaysian. Stamp duty exemption on the instrument of transfer and loan agreement for purchase of first residential home w e f.

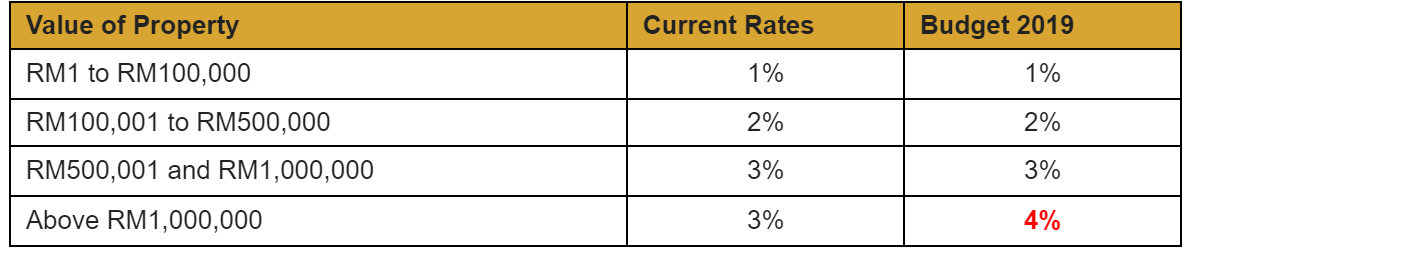

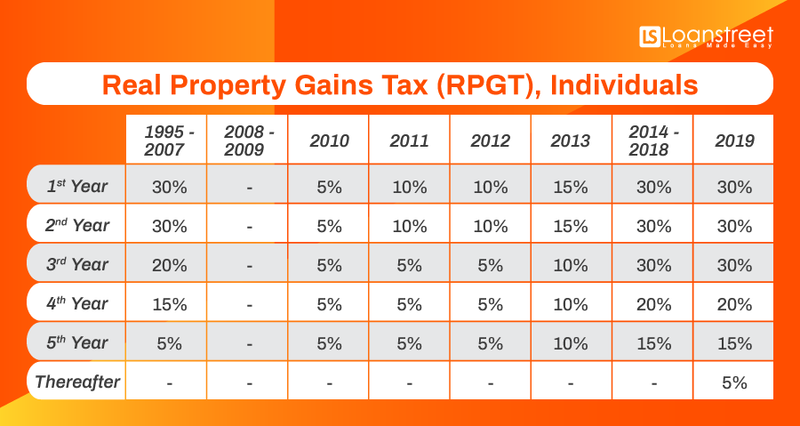

Property including your home or holiday home. On budget 2019 our finance minister mr.

.webp)