Stamp Duty Calculation In Malaysia For Contract

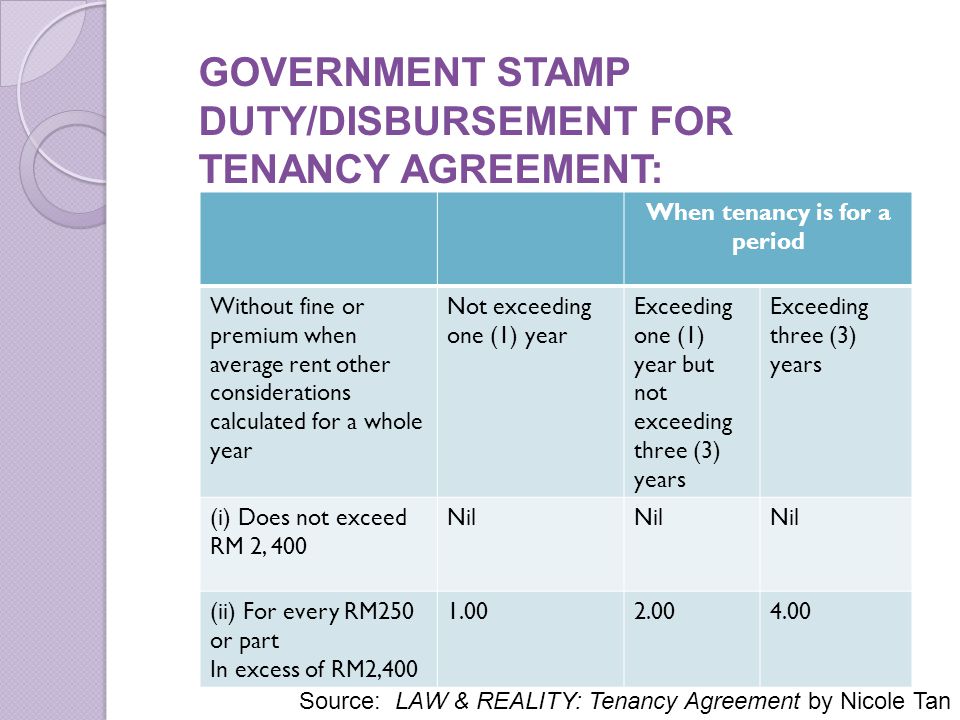

The first rm2 400 of your annual rental is entitled for stamp duty exemption e g.

Stamp duty calculation in malaysia for contract. You can calculate how much spa stamp duty you need to pay for your house. Rm100 001 to rm500 000 rm6000. For first rm100 000 rm1000 stamp duty fee 2.

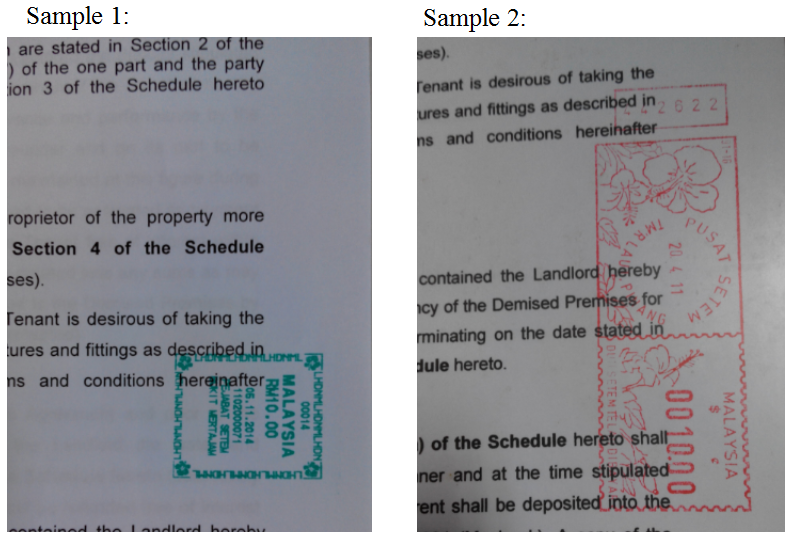

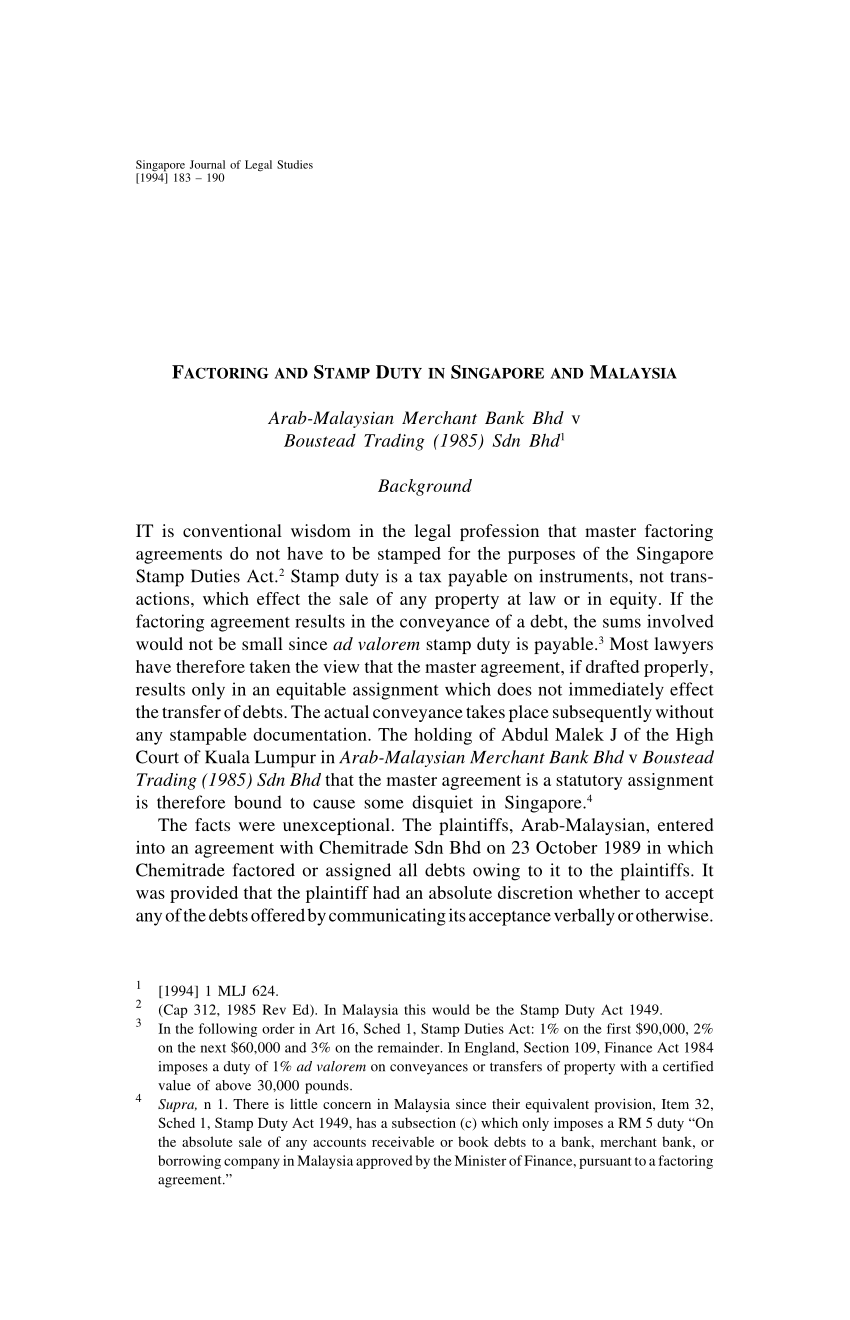

To know how much down payment lawyer fees and stamp duty needed are so. An instrument is defined as any written document and in general stamp duty is levied on legal. The stamp duty is rm1 00 for every rm1000 00 or fractional part of the transaction value of securities payable by both buyer and seller.

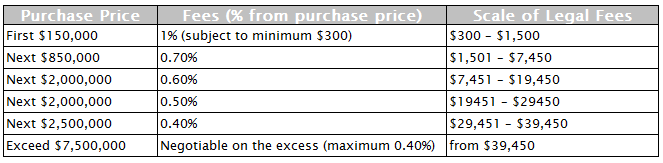

Stamp duty exemption on perlindungan tenang insurance policies and takaful certificates with a yearly premium contribution not exceeding. Transaction costs include brokers commission stamp duty and clearing fees. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law.

Please contact us for a quotation for services required. Calculate the taxable rental. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia securities berhad executed from 1 march 2018 to 28 february 2021.

Stamp duty fee 1. For some people buying a home is a significant milestone that tops many people s lifetime to do lists. Brokers commissions brokers commission rates.

Find out this spa stamp duty calculator here. Rm32 400 rm2 400 rm30 000 step 3. Legal fees stamp duty calculation 2020 when buying a house in malaysia.

Purchasing and hunting for a house can be an exciting and stressful experience. All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess the duty chargeable.