Stamp Act Malaysia 2019

Sabah and sarawak 1 october 1989 p u.

Stamp act malaysia 2019. Peninsular malaysia 5 december 1949. 1 this alert summarizes the key aspects of the guidelines. Peninsular malaysia 5 december 1949.

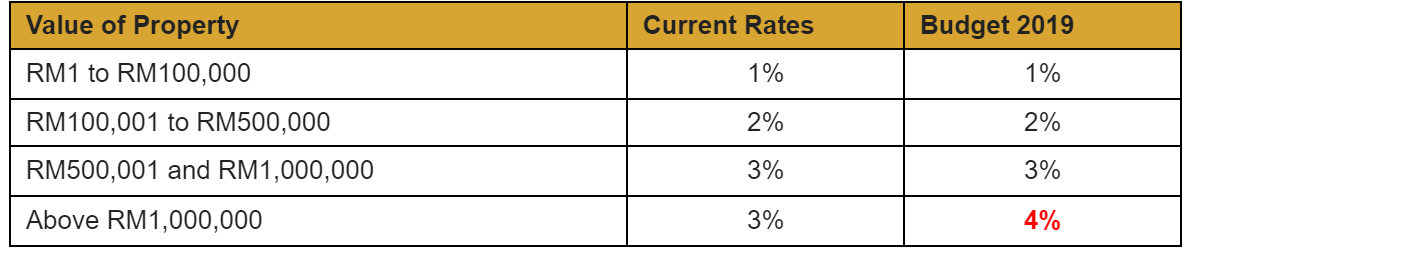

General exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. For first rm100 000 stamp duty fee 2. 2 this act shall apply throughout malaysia.

In general term stamp duty will be imposed to legal commercial and financial instruments. 1 this act may be cited as the stamp act 1949. Following such amendments the malaysian inland revenue board mirb has also published new guidelines which aim to provide guidance and clarification relating to the amended provisions under the stamp.

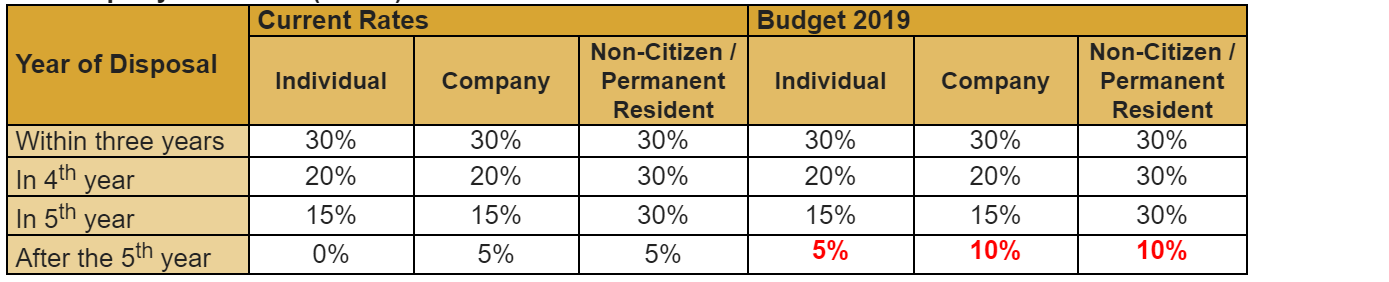

A stamp duty on instrument of transfer of property pursuant to section 68 d of the finance act item 32a of the first schedule to the stamp act has been amended to read as follows. The above amendments came into operation on 1 january 2019. 2 this act shall apply throughout malaysia.

Relief may be given pursuant to section 15 and section 15a. Laws of malaysia act 378 stamp act 1949 an act relating to stamp duties. There are two types of stamp duty namely ad valorem duty and fixed duty.

Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949. However the stamp bill 2017 was again withdrawn from parliament. Amendments to the rpgt act effected in sections 69 69a 69b and 70 of the finance act.

Sabah and sarawak 1 october 1989 p u. 8 laws of malaysia act 378 9stamp laws of malaysia act 378 stamp act 1949 an act relating to stamp duties. 1 this act may be cited as the stamp act 1949.

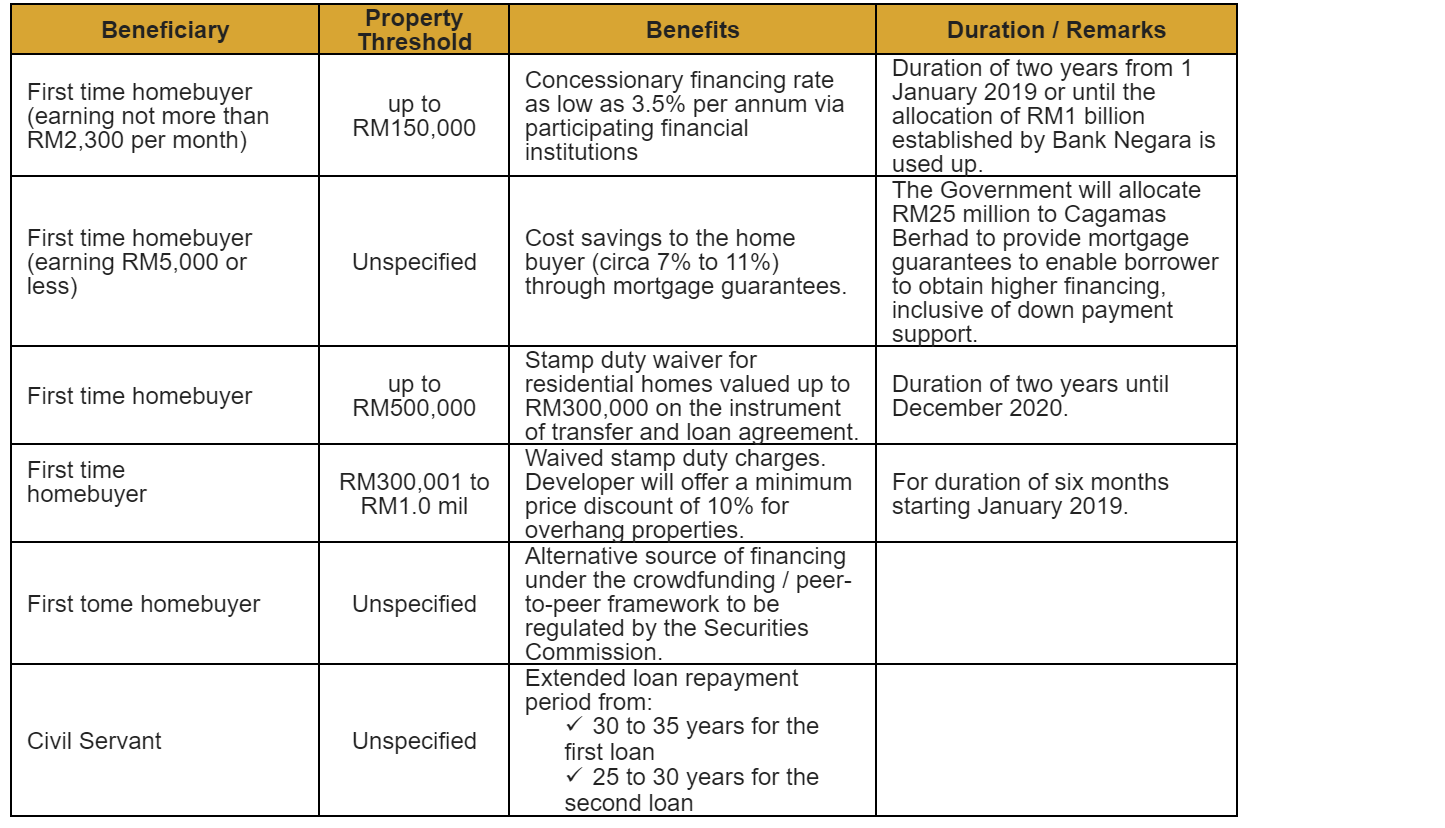

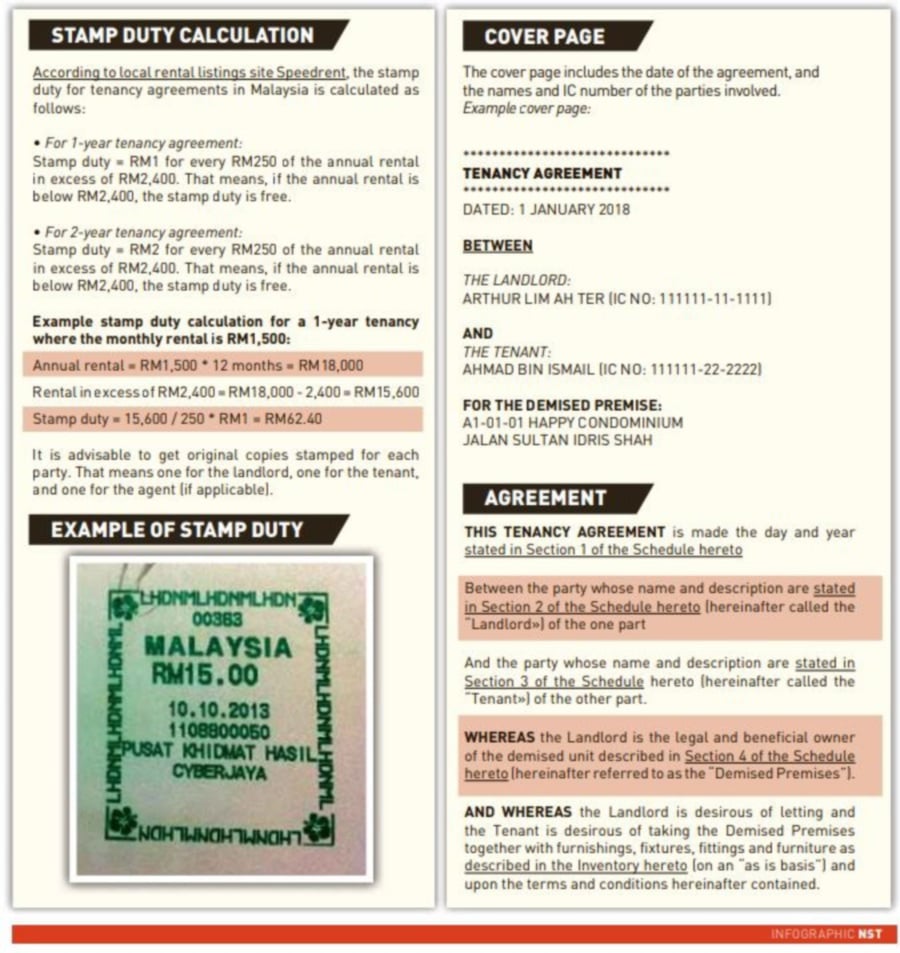

2019 stamp duty scale from 1st january 2019 30th june 2019 stamp duty fee 1. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia securities berhad executed from 1 march 2018 to 28 february 2021. Stamp duty exemption on perlindungan tenang insurance policies and takaful certificates with a yearly premium contribution not exceeding.

The malaysian inland revenue board mirb released on 26 february 2019 guidelines for stamp duty relief under sections 15 and 15a of the stamp act 1949 the guidelines the guidelines take into account the tightening of the stamp duty relief provisions proposed in the 2019 budget. B 441 1989 part i preliminary short title and application 1. Some notable amendments proposed under the stamp bills 2016 and 2017 were passed by the malaysian parliament under the finance act 2018 fa which came into force on 28 december 2018.

Stamp bill 2016 were again introduced and proposed under the stamp amendment bill 2017 stamp bill 2017. B 441 1989 part i preliminary short title and application 1.