Special Voluntary Disclosure Programme Svdp

Further extension of window period in line with the tax svdp.

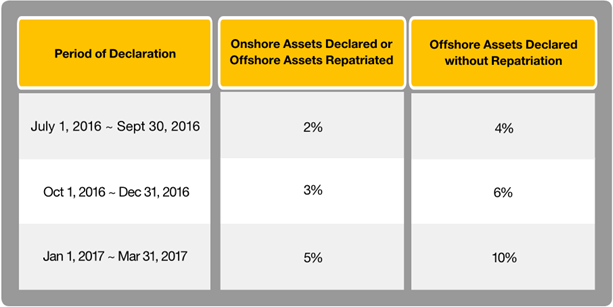

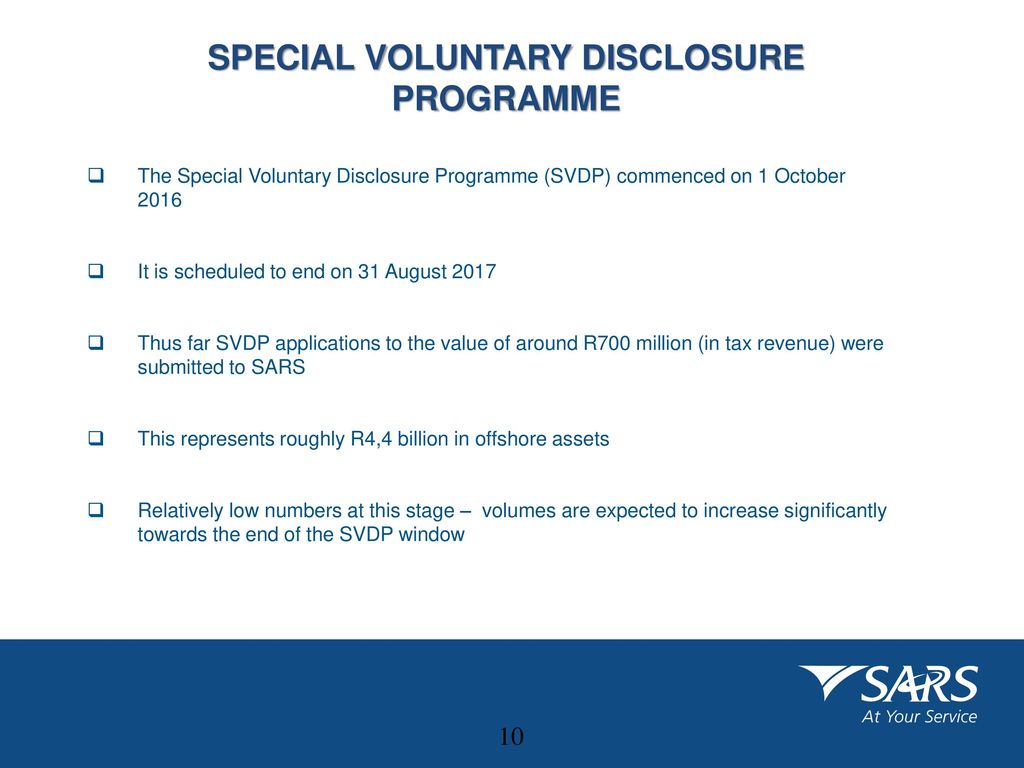

Special voluntary disclosure programme svdp. This programme is offered to encourage taxpayers to voluntarily disclose any unreported income and settle the tax arrears if any within the period of 3 november 2018 until 30 september 2019. For the period 1 october 2016 until 31 august 2017 a special voluntary disclosure programme svdp gave non compliant taxpayers an opportunity to regularise their unauthorised foreign assets and income by voluntary disclosing this information. This voluntary disclosure can be made at the nearest irbm office commencing from 3rd november 2018 until 30th september 2019.

13 oct 16 exchange control circular no. In line with the new automatic exchange of information between tax authorities sars started receiving offshore third party financial data from other tax authorities in 2017. During the 2019 malaysian budget announcement on 2 november 2018 the minister of finance introduced a new special voluntary disclosure programme svdp for eligible taxpayers.

Sabin who was addressing tax experts and reporters at kpmg malaysia s dialogue with the irb yesterday acknowledged that. The sars permanent voluntary disclosure programme vdp is administered under the tax administration act 2011 with effect from 1 october 2012. This special program is part of the government s efforts in tax reformation.

Special program 03 11 22018 30 06 2019 made on the reported information. On 2 november 2018 a new special voluntary disclosure programme svdp was announced by the minister of finance during the budget 2019 to encourage taxpayers to voluntarily disclose their previous undeclared income accurately and to settle tax arrears if any this was announced in view of malaysia s participation in the automatic exchange of information with foreign tax. 8 2016 exchange control special voluntary disclosure programme.

Inland revenue board irb chief executive officer ceo datuk seri sabin samitah has called on taxpayers to trust the government s intention to introduce the special voluntary disclosure programme svdp which was announced during budget 2019 last year. The special voluntary disclosure programme svdp kicked off on 1 october 2016 and runs until the end of june 2017. The special program on voluntary disclosure is only offered from 0 3 november 2018 until 30 june 2019.

It is to encourage taxpayers to make voluntary disclosure in reporting their income to increase tax collection for the country s development. The svdp consists of an exchange control leg and a tax leg. 4 2017 exchange control special voluntary disclosure programme.

The special voluntary disclosure programme svdp was for taxpayers who want to disclose their offshore assets and income.