Sole Proprietorship Taxes Malaysia

Ku nan settles lawsuit on rm57 mil income tax arrears.

Sole proprietorship taxes malaysia. This page is also available in. To compute their tax payable. Full ownership a sole proprietorship is owned 100 by a single person.

You have to report this income in your tax return. For your personal income tax remember that you still need to submit form e be online. The ssm of malaysia enforces the companies act 2016.

Husband and wife have to fill separate income tax return forms. There are two different kinds of taxes in malaysia which are a direct and indirect tax. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate.

To check and sign duly completed income tax return form. Remember llps are separate entities from their partners. As mentioned before the sole proprietorship is the most popular business structure in malaysia.

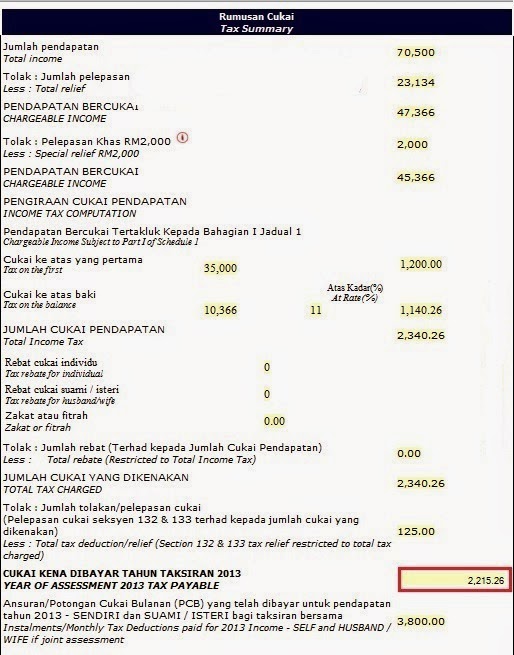

So they file tax separately. Thereby no separate tax return file is needed sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26. For many small scale online businesses in malaysia sole proprietorship single owner or partnership more than one owner is enough and the cheapest option.

The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. Sole proprietorship malaysia comes with enticing policies where the owner of the company doesn t need to corporate tax. A sole proprietorship in malaysia makes no difference between the natural person who owns it and the business sole proprietorships are pass through entities.

Precedent partner is also responsible for informing lhdnm officially if the partnership ceases changes to a sole proprietorship private limited company. The cost evaluation is marginal and way lower when compared with other form of business in this nation. For many small scale online businesses in malaysia sole proprietorship single owner or partnership more than one owner.

All profits and losses go directly to the business owner. Self employed sole proprietors partners if you have received full time or part time income from trade business vocation or profession you are considered a self employed person. Please do not submit the following for llps.

Depending on your nature of business you can register as sole proprietorship partnership limited liability partnership or company. As such sole proprietorships also fall under their jurisdiction. Form b that s for if you re a sole proprietor or form p that s for a partner in a conventional partnership.