Socso Late Payment Penalty

Upon late payment of epf challan two arrears ensue on the employer as follows.

Socso late payment penalty. For example january contributions should be paid not later than february 15. Ssm offers 90 discount on penalty compound valid until 30 4 2020. Access to internet banking makes epf contribution payments much easier now.

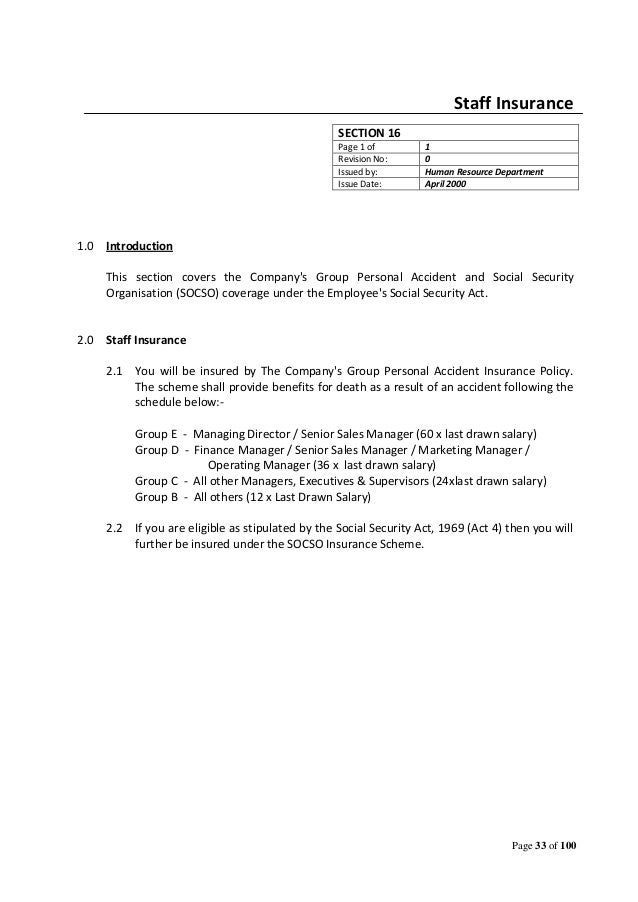

The employer is liable to pay monthly contributions within 15 days of the following month. The district s social security organisation socso. Epf interest for late payment under section 7q.

Ilpc is charged for late payment of contributions at the rate of 6 percent per annum for each day of late payment contributions. Socso eis contribution payment deadline. For other contribution payments late payment charge dividend a maximum limit of rm500 per transaction can only be made until 3pm.

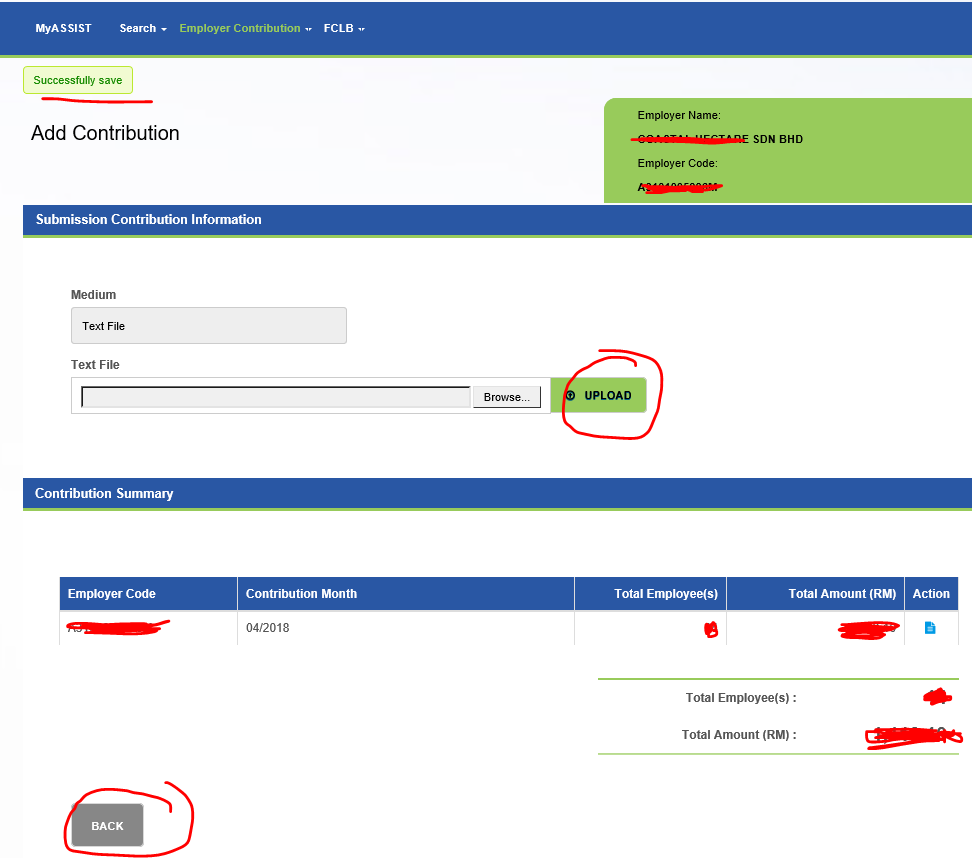

The contribution should be made before or by the 15th of each month to avoid a fine for late payment imposed on employers socco said in a statement. Failing to submit the forms remit the payment within the period will result in late interest penalty charged by perkeso. Starting 1 january 2018 cheque payments and money order postal order will not be accepted.

If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing. Epf late payment penalties. Bernama reports that socso s public relations unit said the eis payments within this period would be for january 2018.

Cash payments for monthly contribution form a has ceased since 1 january 2018. 15th of the following month sources from perkeso fine for late payment contribution. Interest on late payment of contributions will be imposed at a rate of 6 per annum for each day of contributions not paid within the stipulated period.

Furthermore a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. For every single day that there is a delay in epf payment. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the third schedule.

Perkeso socso perkesoofficial september 30 2020. When an employer fails to deposit the epf contribution before its deadline then he is liable to pay an epf interest of 12 p a. Mtd pcb contribution payment deadline.

15th of the. Regularly updated free to use and real time customer support.