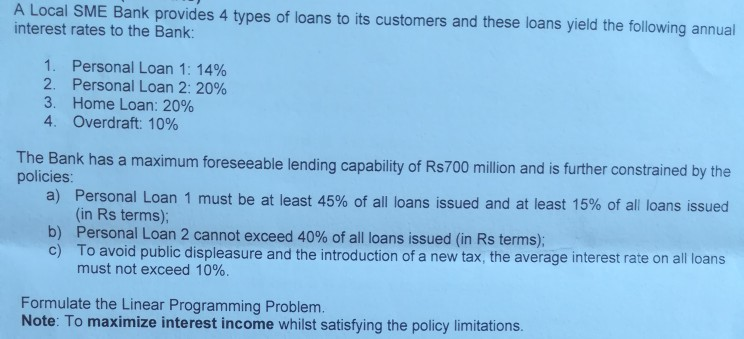

Sme Bank Personal Loan

6 months to 5 years.

Sme bank personal loan. Apply micro loan commerical industrial property loan. Chief among them is that collateral is not a compulsory requirement the interest rates are reasonable and the loan amount given can be able to start up or run a normal sme. Sme bank is fully committed in driving the nation s economic growth by providing not only business financing assistance but also development expertise to small and medium scale enterprises allowing businesses to prosper and grow.

With cimb s sme banking solutions tools smes can supercharge their potential for growth. The right banking partner can effectively help your sme grow. Check interest rates using our sme loan calculator and get more credit line.

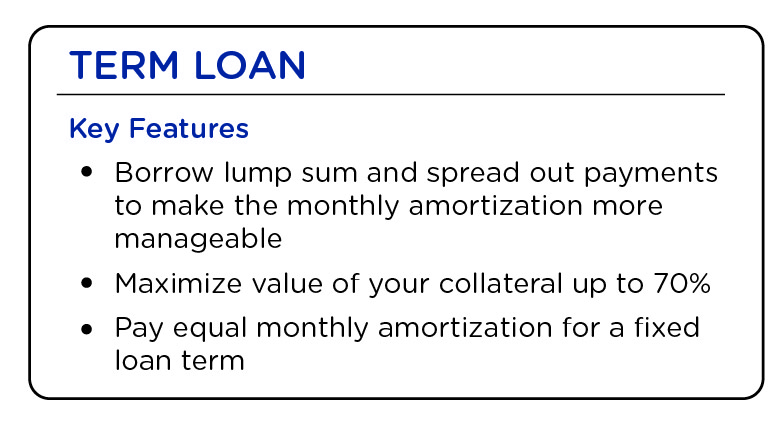

Sme business loan a general purpose term loan designed to meet a wide variety of business purpose for smes from one off purchase of stock through to additional cash flow for your business short term finance. Basically the sme bank business loans have a lot of related services and benefits compared to other types of loans. This is an independent survey that talked to 1 750 sme s on their experience when it comes to borrowing money which found there was an 90 billion funding gap.

All the 16 schemes have different purposes interest rates eligibility repayment tenures etc. Business loan online application to grow your business is now simpler faster and smarter with dbs sme banking. The bank offers 16 types of sme loans some of which are sme ebiz loan stand up india simplified small business loan sme smart score pm mudra yojana warehouse receipt finance etc.

Judo bank commissioned the sme banking insights report in 2019. Dbs business banking services comprises new account opening online business loan equipment loan trade collections a wide range of banking products for sme. Loans from k5 000 to k500 000.

Fixed interest rate calculated daily charged monthly.