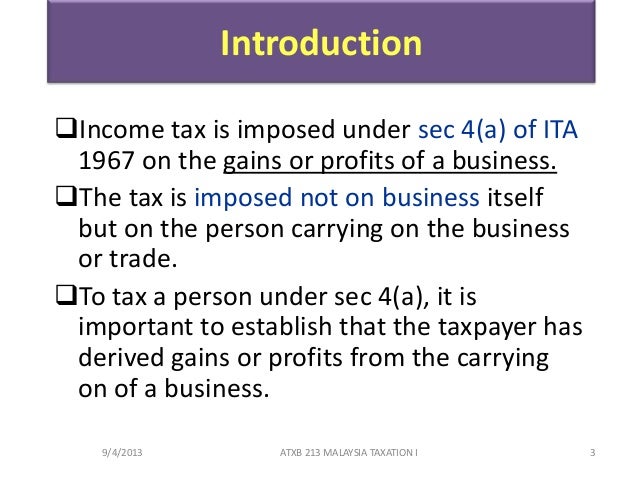

Section 4 Income Tax Act Malaysia

As a guidance the criteria.

Section 4 income tax act malaysia. The income tax act 1967 malay. Charge of income tax 3 a. Short title and commencement 2.

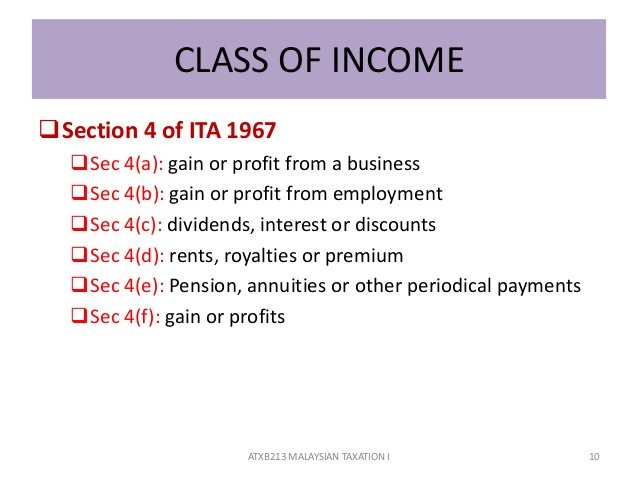

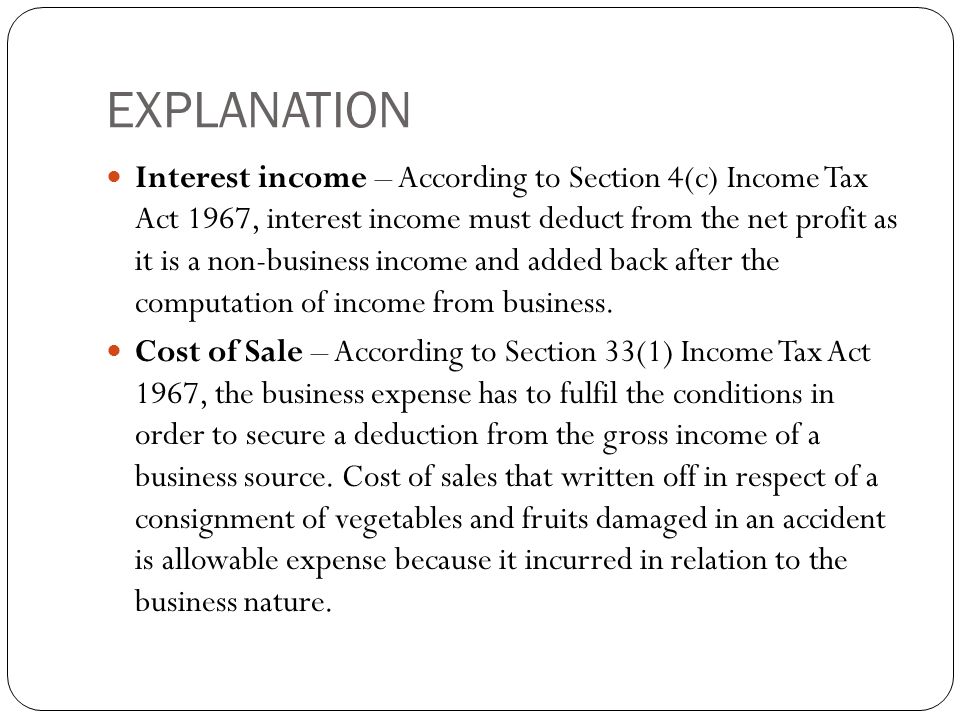

1961 income tax department all acts income tax act 1961. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax. Income falling under section 4 f of the income tax act 1967 ita 1967 includes any other income that is not obtained from business employment dividends interests discounts rents royalties premiums pensions or annuities.

Scope of total income. The income tax department never asks for your pin numbers. Non chargeability to tax in respect of offshore business activity 3c deleted 4.

Apportionment of income between spouses governed by portuguese civil code. Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. Charge of income tax 3a deleted 3b.

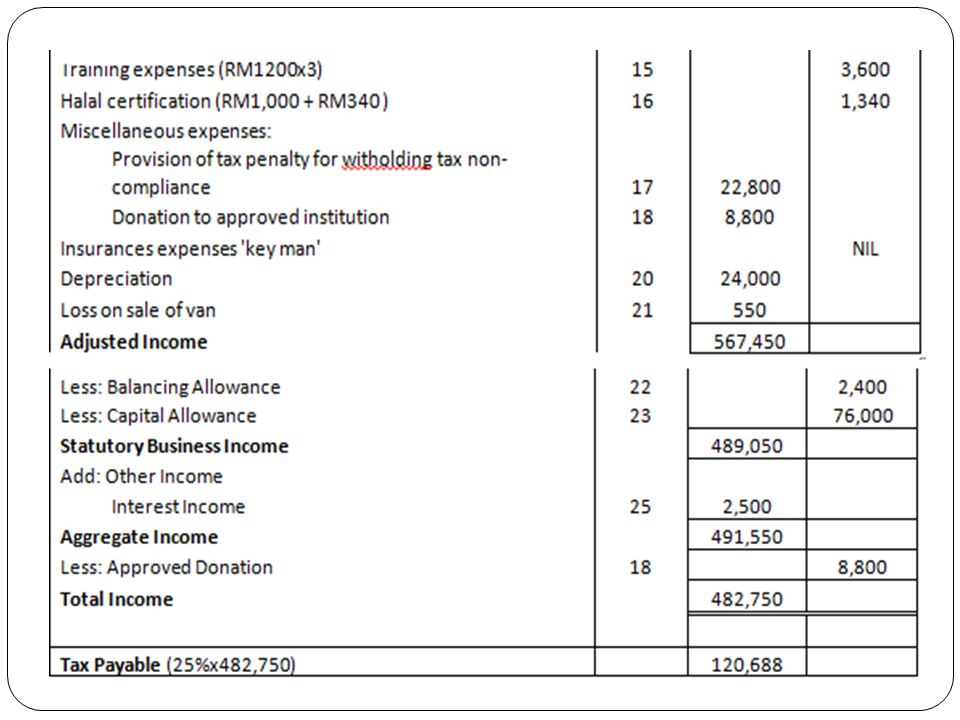

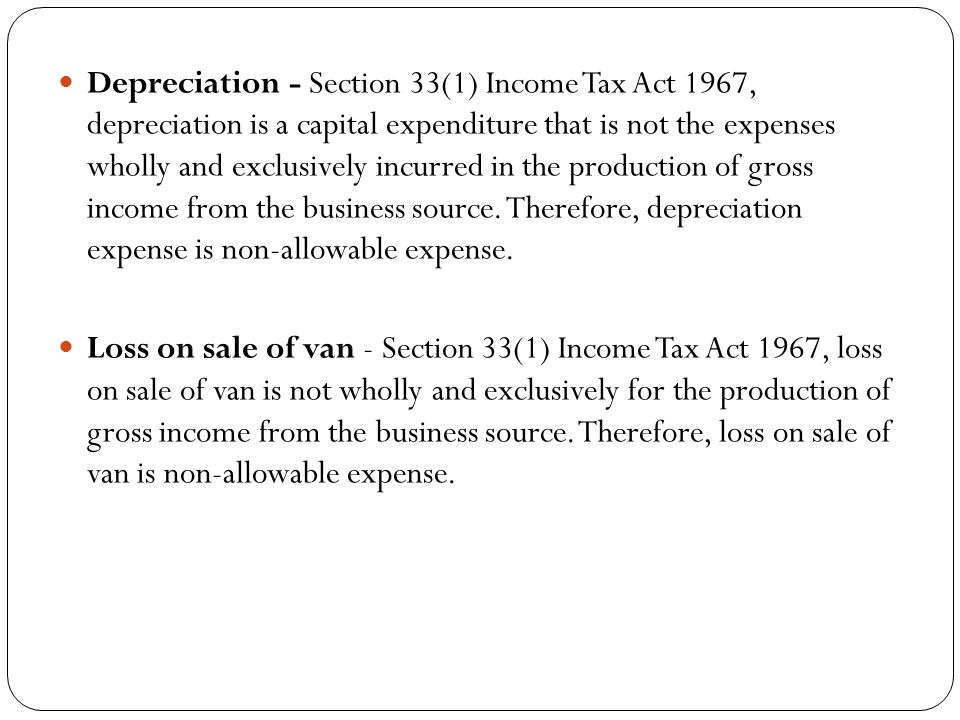

Perusing the cases involving income tax it is obvious that most of the cases revolve around issue of what constitutes income. Short title and commencement 2. Chapter 4 adjusted income and adjusted loss section.

Non chargeability to tax in respect of offshore business activity 3 c. Of chargeable income chapter 4 adjusted income and adjusted loss rencana akta cukai pendapatan 1967 pindaan sehingga akta 719 tahun 2011 akta 53 tarikh keluaran. Short title and commencement 2.

Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Section 4 f of the income tax act 1967 the act which is derived from malaysia and received by a nonresident is subject to wt of 10 under section 109f of the act.

Charge of income tax 3 a. Laws of malaysia act 53 arrangement of sections income tax act 1967 part i preliminary section 1. This is due to the inadequacies of section 4 income tax act 1967 in effectively defining income.

Interpretation part ii imposition and general characteristics of the tax 3. Classes of income on. The determination of whether a payment made to a non resident falls under section 4 f depends on the facts and circumstances of each case.

Interpretation part ii imposition and general characteristics of the tax 3. The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. Income under section 4 f ita 1967.

Non chargeability to tax in respect of offshore business activity 3 c. Revolves around section 4 income tax act 1967 which defines income. Interpretation part ii imposition and general characteristics of the tax 3.