Section 24 1a Income Tax Act 1967

Debt arising from services to be rendered or use of property to be dealt with section 24 1 of the ita is to be amended to take effect from.

Section 24 1a income tax act 1967. Short title and commencement 2. Income tax act part. Section 114 1a offence by taxpayer s advisor.

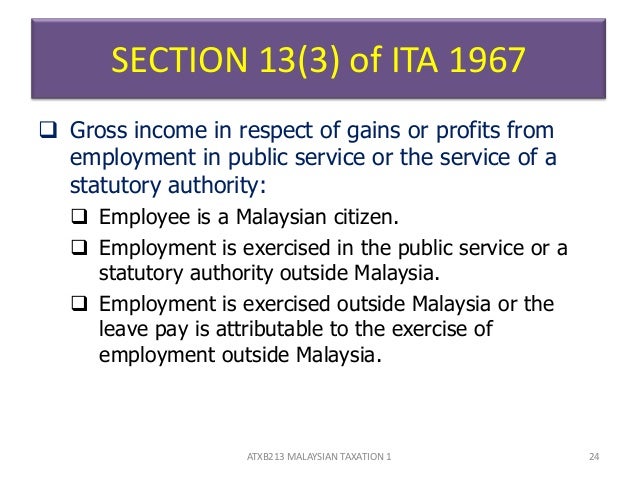

Non chargeability to tax in respect of offshore business activity 3 c. Chapter 3 gross income section. Part part iii.

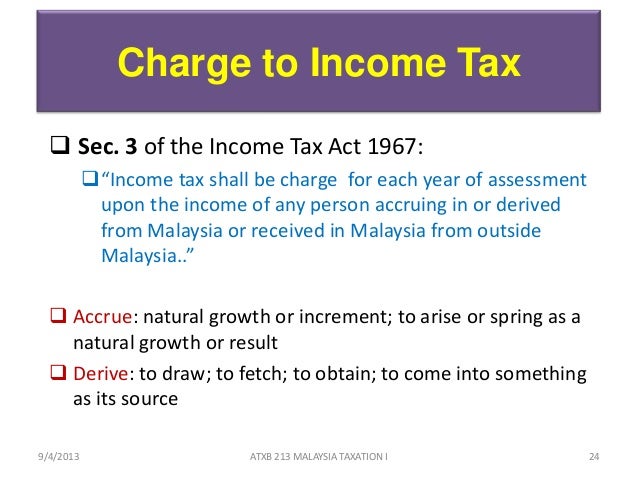

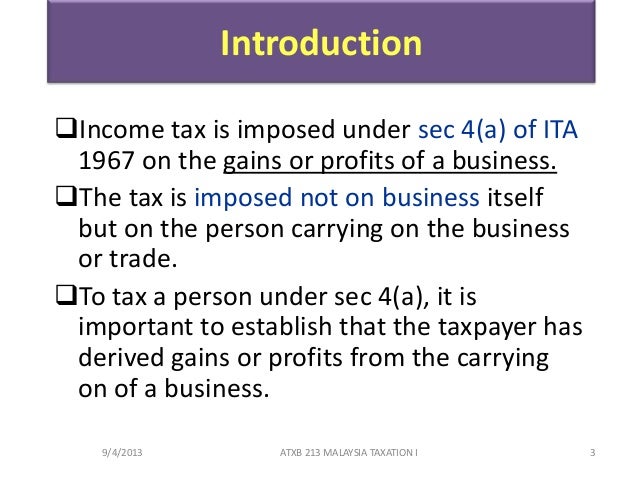

In this case there is a bc of 15 000 which is taxable as income. Interpretation part ii imposition and general characteristics of the tax 3. Part iii ascertainment of chargeable income chapter.

Charge of income tax 3 a. This is not applicable if you are occupying the only house you own. Interpretation p art ii imposition of the tax 3.

The minimum fine under section 114 1a be reduced to rm1 000 to be consistent with section 114 1. Title income tax act. The 6 month time frame for self amendment is too short.

Classes of income on which tax. Act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Some of the major amendments are as follows.

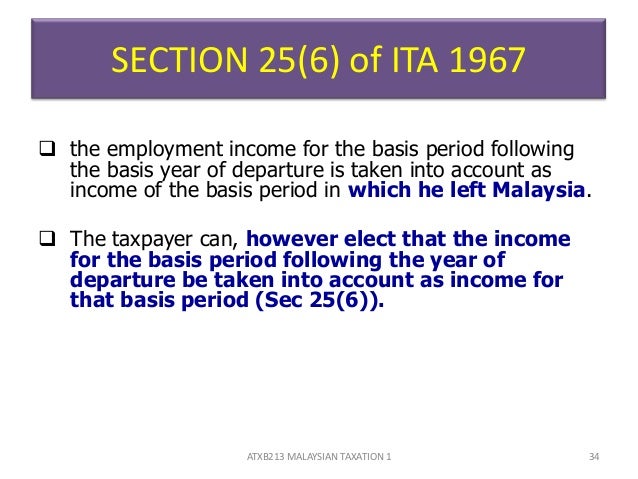

Manner in which chargeable income is to be ascertained p art iii ascertainment of chargeable income chapter 1 basis periods 5. Chapter 4 adjusted income and adjusted loss. This is an exemption allowed to every taxpayer where a sum equal to 30 of the net annual value does not come under the tax limit.

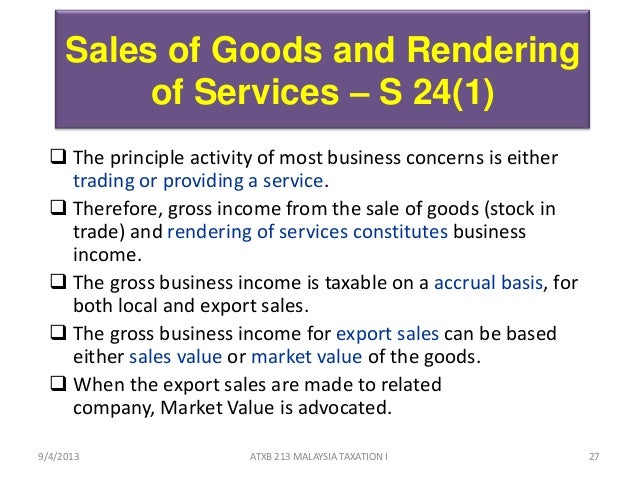

Akta cukai pendapatan 1967 pindaan sehingga akta 719 tahun 2011 akta 53 tarikh keluaran. There are 2 types of tax deductions under section 24 of the income tax act. The income tax act 1967 ita which may have an impact on your tax position including the estimate or revised estimate of tax payable.

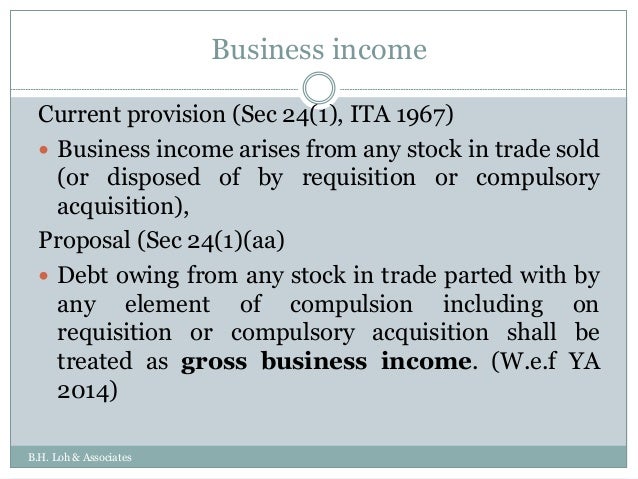

Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. Mechanics of assessment 5 1 self amendment of tax return section 77b understatement of tax self amendment is allowed for only. Secondly a new section 24 1a has been introduced to stipulate that any sum received by a person in respect of any services to be rendered or the use or enjoyment of any property shall be treated as gross income for the relevant period in which the sum is received notwithstanding that there is no debt owing in respect of such services or use or enjoyment.

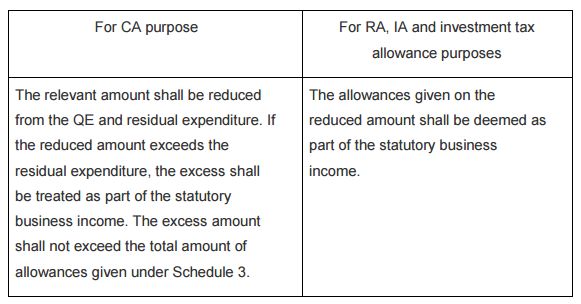

Basis period to which gross income from a business is related. Act 543 petroleum income tax act 1967 arrangement of sections p art i preliminary section 1. Section 24 not elected capital allowance schedule for company a seller since section 24 is not elected it is necessary to compute ba bc for company a based on the selling price of 25 000.

Short title extent and commencement 2. In section 24 1 or in respect of interest of the kind referred to in section 24 5.