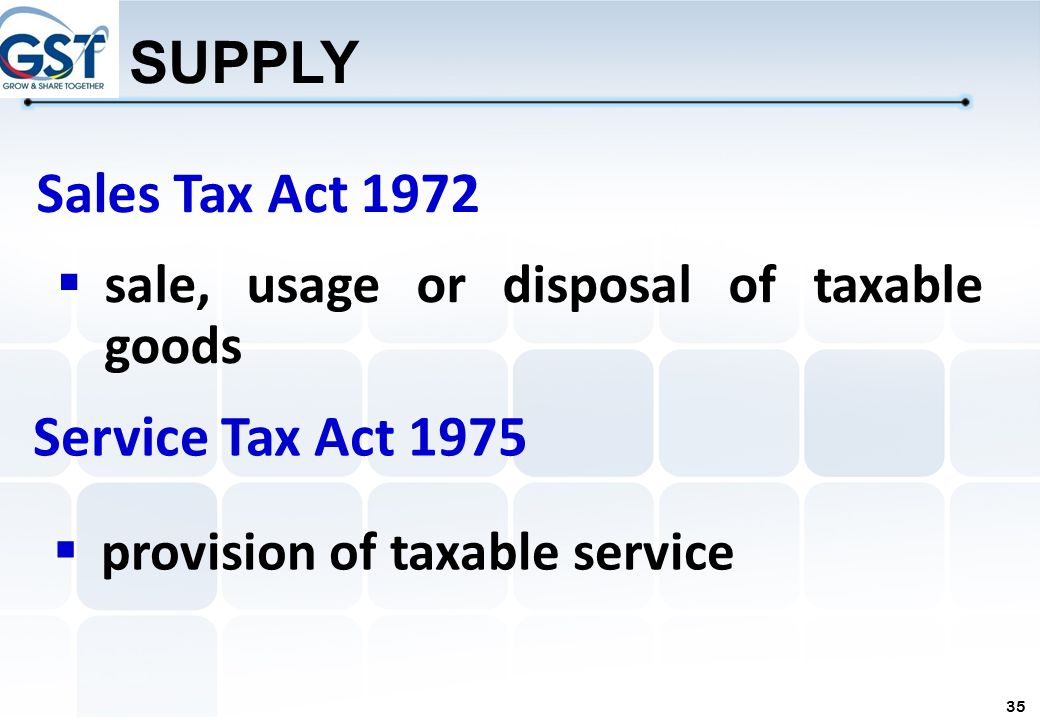

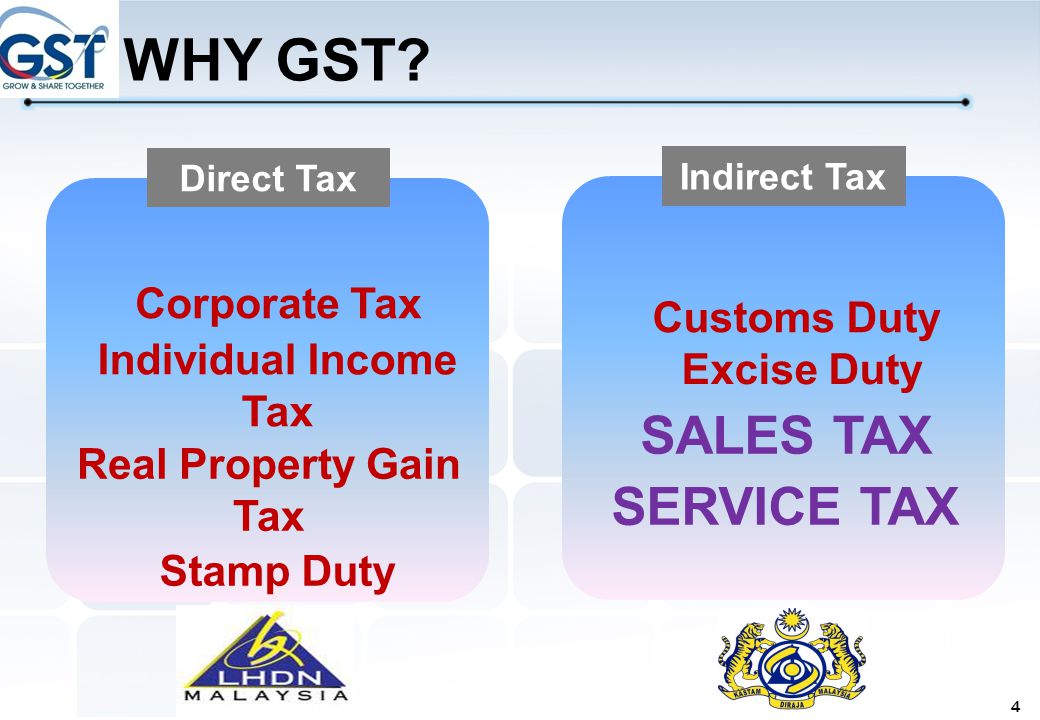

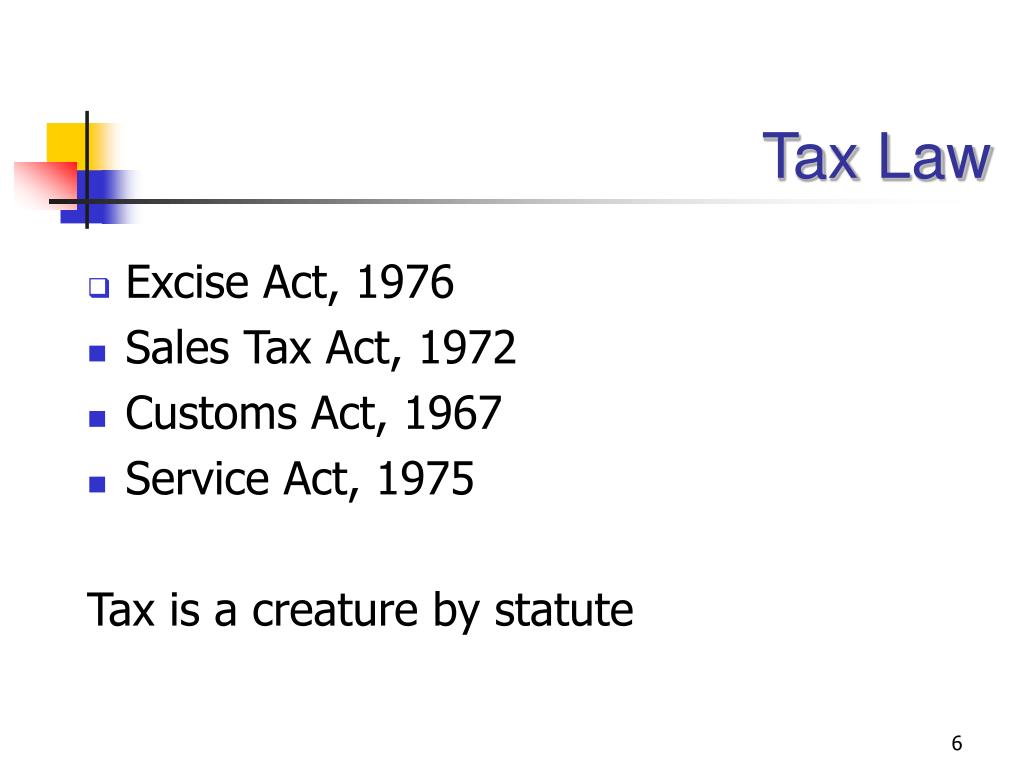

Sales Tax Act 1972

Finance act 1972 c.

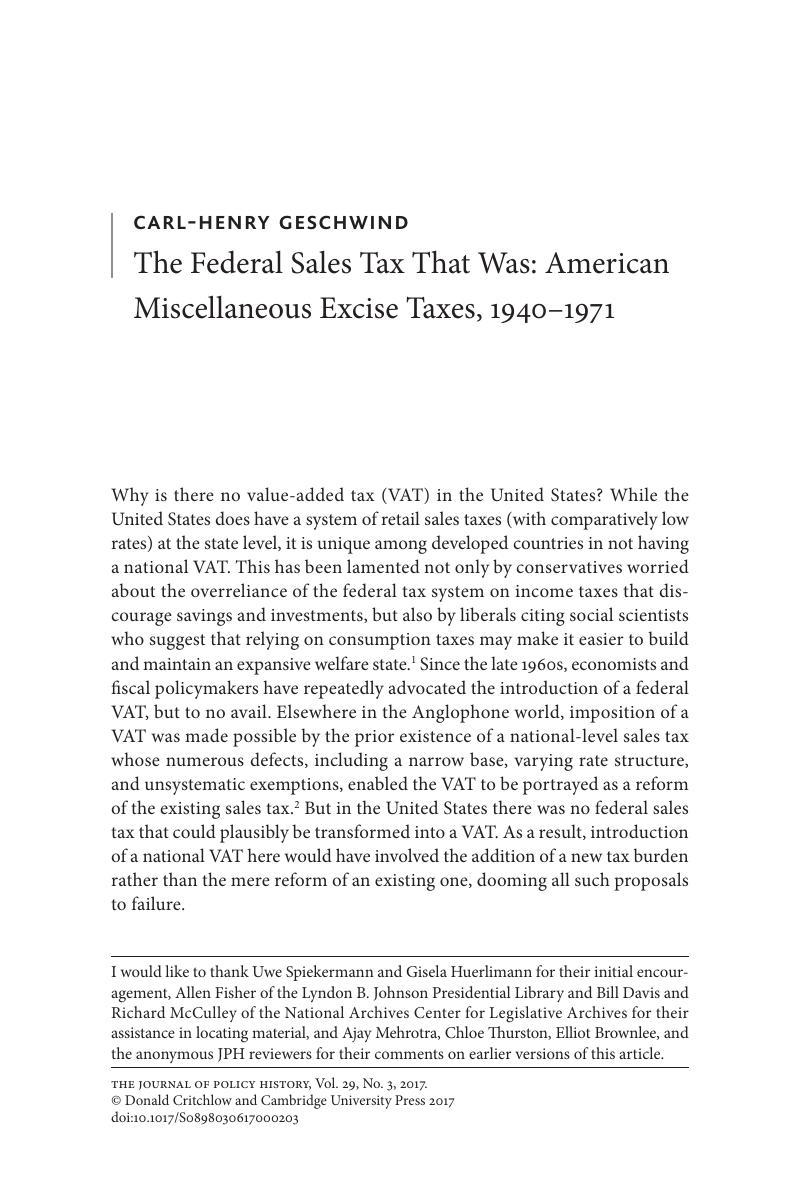

Sales tax act 1972. Amendments as to accounting periods. Returns of distributions which are not qualifying distribu tions. Act 64 sales tax act 1972 incorporating all amendments up to 1 january 2006 064e a1183 fm page 1 friday march 31 2006 5 54 pm prepared for publication by malayan law journal sdn bhd and printed by percetakan nasional malaysia berhad kuala lumpur branch 2006 2 sales tax act 1972.

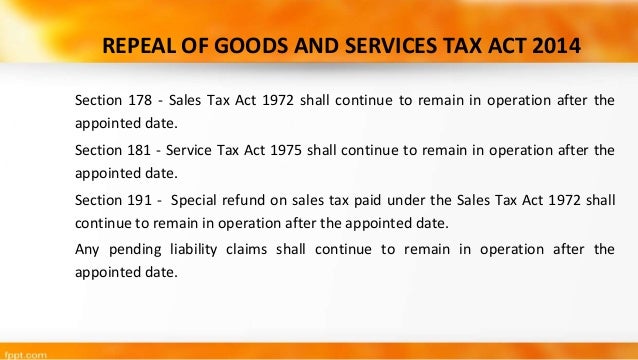

Refund section 31 salex tax act 1972 the act allows a trader vendor to claim sales tax refund on raw material component sold to a licensed manufacturer. Such provisions are necessary to ensure due compliance with the provisions of the sales tax act 1972 and the sales tax regulation 1972. Part x of the sales tax act 1972 makes provisions for offences and penalties.

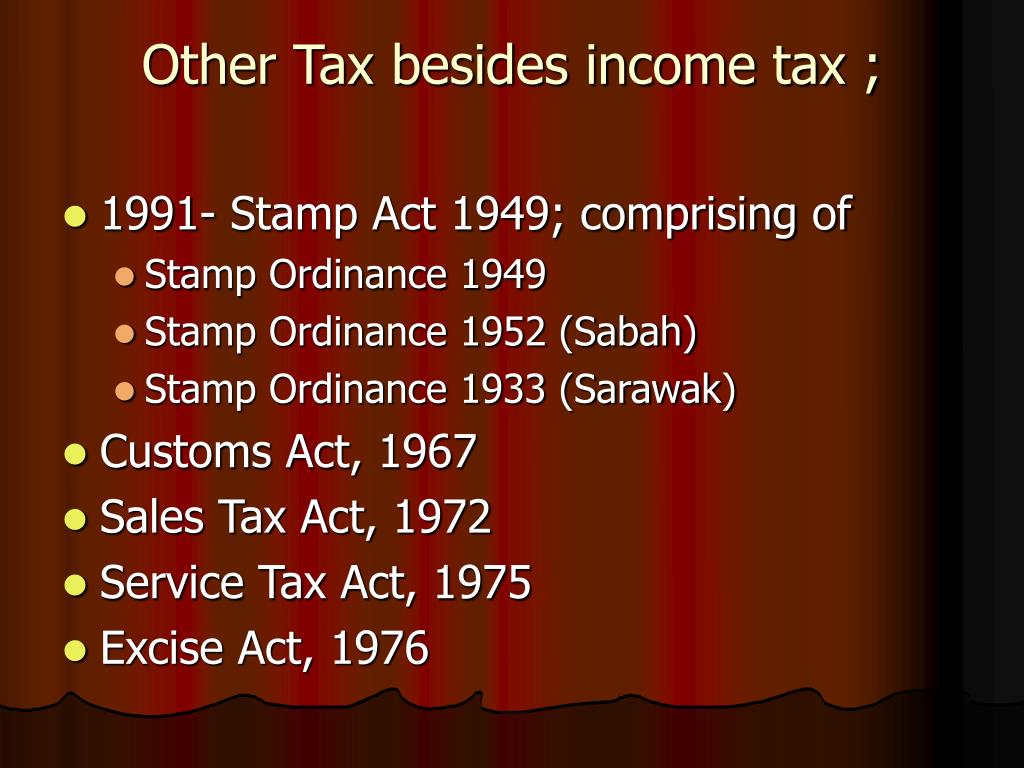

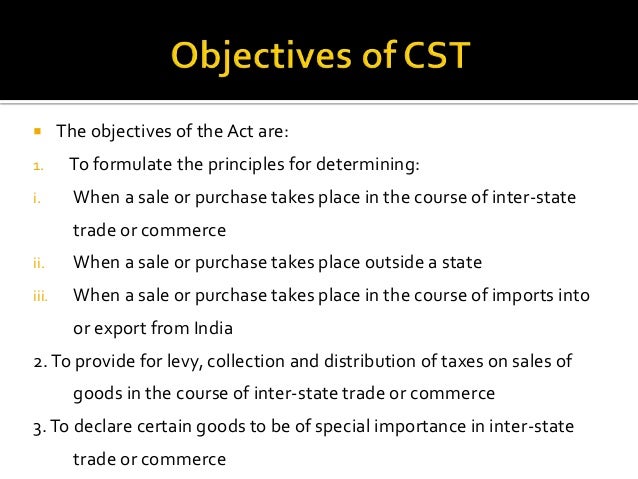

74 of 1956 an act to formulate principles for determining when a sale or purchase of goods takes place in the course of. 29 february 1972 p u b 72 1972 be it enacted by the seri paduka baginda yang di pertuan agong with the advice and consent of the dewan negara and dewan rakyat in parliament assembled and by the authority of the same as follows. The sales tax act 1990 as amended up to 30th june 2019 4 the sales tax act 1990 as amended up to 11th march 2019 5 the sales tax act 1990 as amended up to 01 07 2017 6 the sales tax act 1990 amended up to 31 08 2016 7.

1 4 1973 vide sec. C diplomatic mission means a mission recognized as such under the diplomatic and consular privileges act 1972 ix of 1972. B diplomat means a person entitled to immunities and privileges under the diplomatic and consular privileges act 1972 ix of 1972.

List of acts of 1972. Home actsofparliamentfromtheyear the central sales tax amendment act 1972. The court of jurisdiction is as provided under section 47 of the sales tax act 1972.

In this system a trader pays sales tax during importation or purchases of raw material component and sells at a price excluding sales tax to a licensed manufacturer with cj no 5 facility. An act further to amend the central sales tax act 1956. A act means the sales tax act 1990.

Amendments as to meaning of distribution. Power to make regulations modifying or replacing schedules. The central sales tax amendment act 1972.

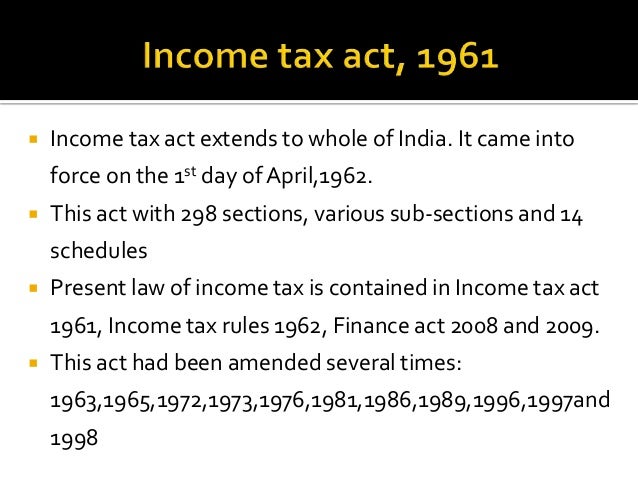

Payments in respect of which company is liable to account for income tax. 2 this section and sub section 1 of section 14 shall come into force at once and the. Amendments made to the act by act 61 of 1972 came into force in the said districts w e f.

Act 64 sales tax act 1972 an act to make provision for the charging levying and collecting of sales tax.